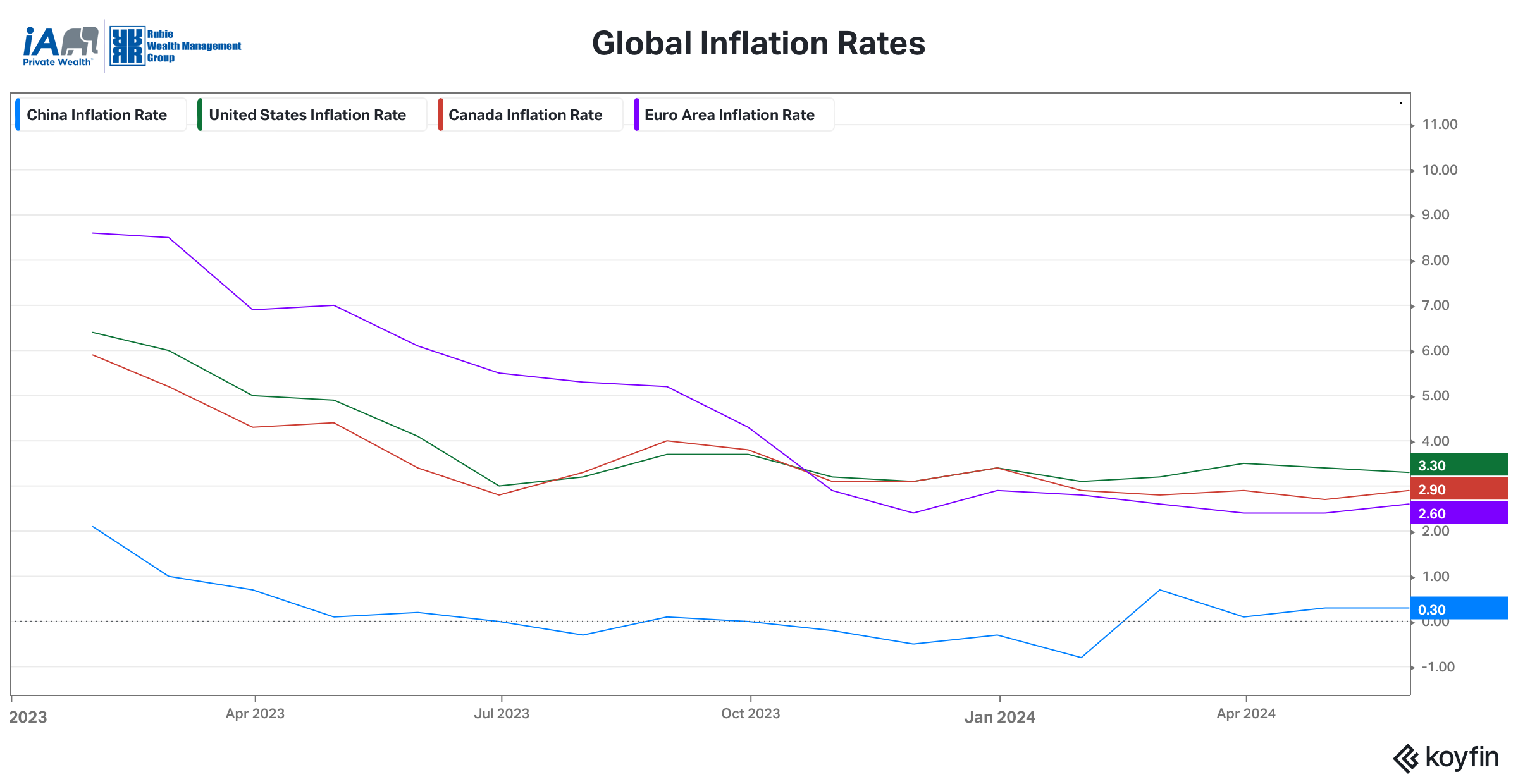

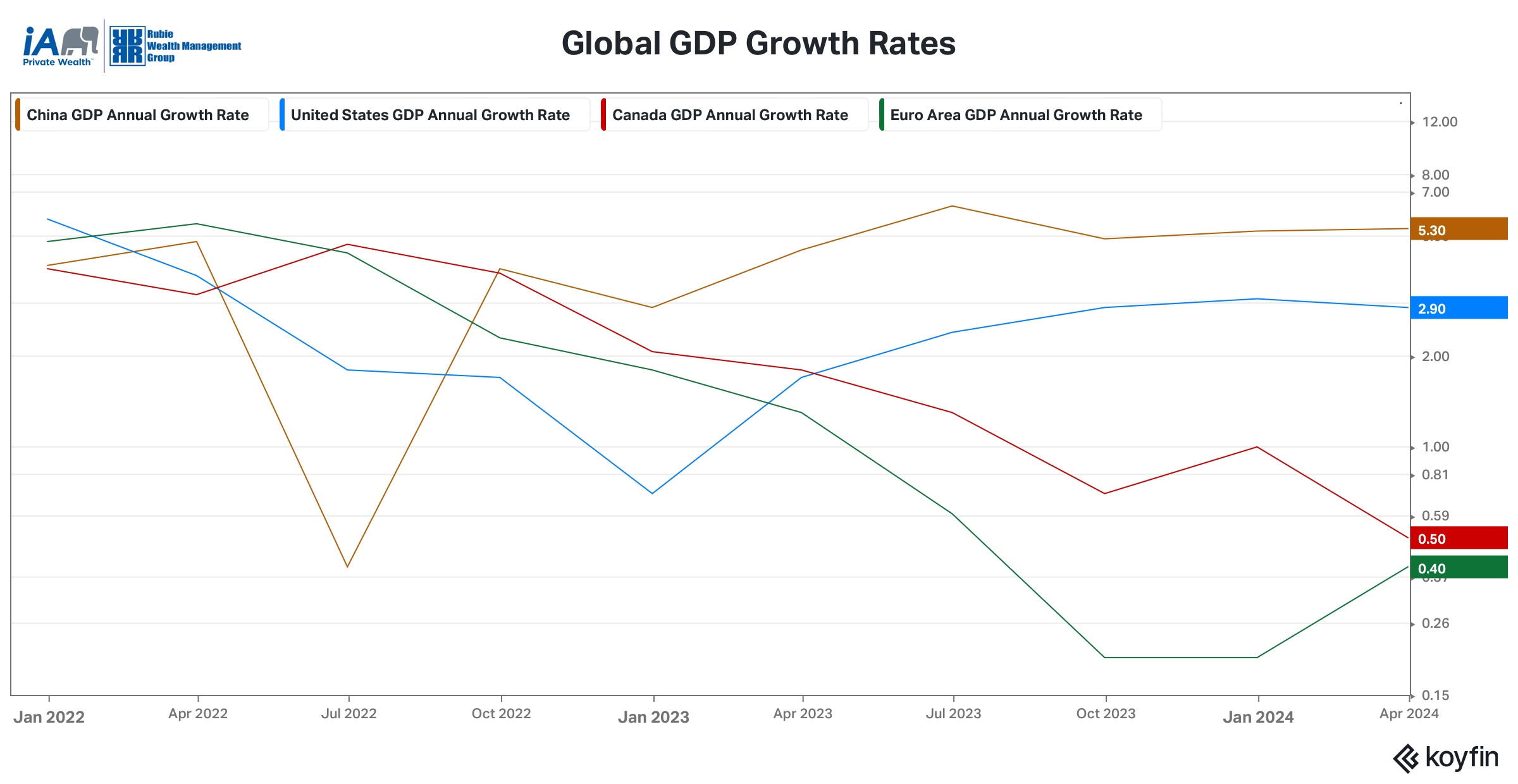

Monthly Market Analysis July 2024 Economy United States he U.S. economy continues to gradually slowdown from the fast paced growth that we saw in 2023. The economy generated 272,000 jobs in May, which is still robust, but the unemployment rate has also risen from 3.6% last May and is now 4%. During the first quarter of 2024, U.S. economic growth as measured by GDP lead the G7 (United States, United Kingdom, France, Germany, Italy, Canada, and Japan) economies at 2.9%. During the second quarter of 2024, most economists expect the United States to continue leading the G7 economies in economic growth, but GDP is expected to fall well below its current level. The U.S. Bureau of Economic Analysis will be releasing second quarter GDP data on July 31st. Consumer spending also slowed as retail spending grew merely 0.1% in May. In the month of May, the highly influential U.S. inflation rate slightly declined to 3.3%. The rate of inflation was still too high for the United States Federal Reserve to lower the Federal Funds rate in their meeting last month. Canada Canada’s economy has stalled. In the first quarter of 2024 Canada’s GDP grew at an annual rate of 0.5%. The Canadian job market added a strong 27,600 jobs in May, but at the same time unemployment has also increased. The Canadian unemployment rate has grown from 5.2% last May to 6.2% this May. Canadian consumers cut back on spending during the first three months of this year, but retail spending unexpectedly rebounded to 0.7% in the month of April. Canada’s inflation rate increased from 2.7% to 2.9% in the month of May. Despite the increase in inflation, the Bank of Canada cut interest rates by 0.25% last month, moving Canada’s overnight interest rate to 4.75   Markets The broad U.S. stock market was up last month as some of the largest technology companies in the world have continued to grow in value. The U.S. S&P 500 index grew by 3.47% in June and the Nasdaq 1000 which is heavily weighted in technology stocks grew by 6.18%. We are halfway through 2024 and the U.S. S&P 500 index is up by 14.48% and the Nasdaq 100 is up by 16.98%. Although oil prices have rebounded by 13.68% this year, Canada’s TSX Composite Index was down -1.77% in June and is up just 4.38% this year. Inflation has retreated in Europe where the inflation rate is now at 2.6%. North American inflation remains sticky and has taken a slower downward path. The slower pace of decline in inflation in the United States has delayed the prospect of interest rate cuts by the U.S. Federal Reserve. The U.S. bond and stock market have largely ignored the impact of delayed interest rate cuts from the Federal Reserve as the relatively strong economy has allowed many companies to generate higher profits this year. Although the U.S. economy is in a relatively good place, with the expectation of reasonable growth, as well as stable or declining interest rates; the upcoming elections will likely result in market volatility as we approach the Fall months. 1 (Source: Bank of Canada) 2(Source: Statistics Canada) 3(Source: United States Bureau of Labour Statistics) 4(Source: United States Federal Reserve) 5(Source: United States Census Bureau) 6(Source: Koyfin as of June 28,2024) * This information has been prepared by Desmond Rubie, BCom, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc. IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.  Desmond Rubie, BCom, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private Wealth 26 Wellington Street East, 2nd Floor Toronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 Desmond.Rubie@iaprivatewealth.ca iaprivatewealth.ca |

Leave a Reply