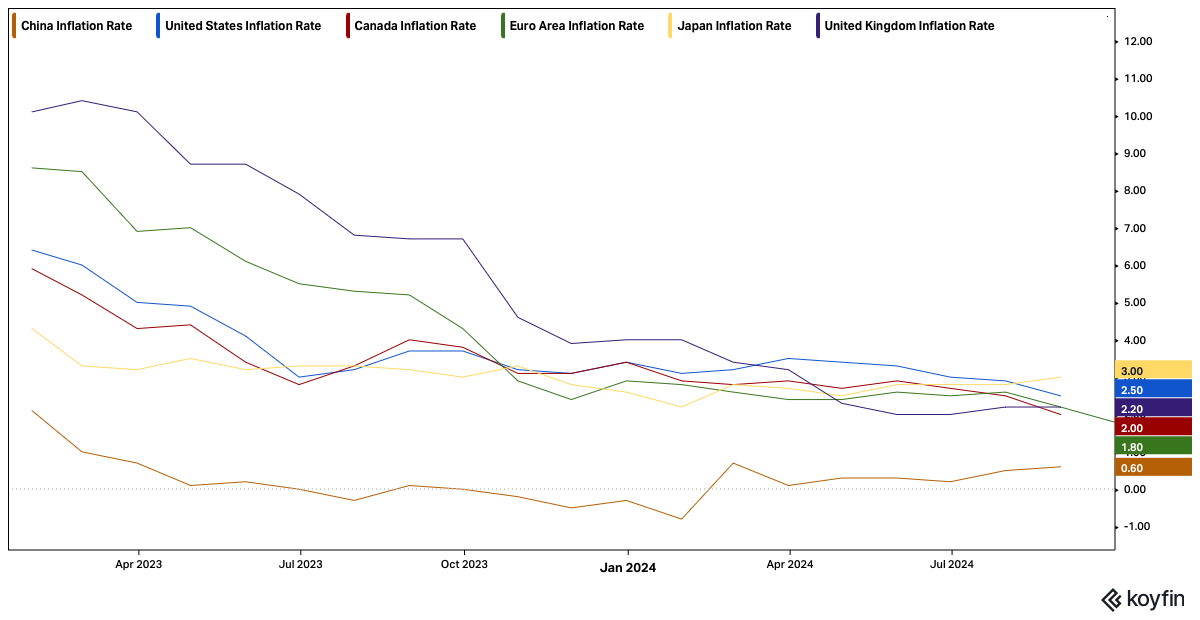

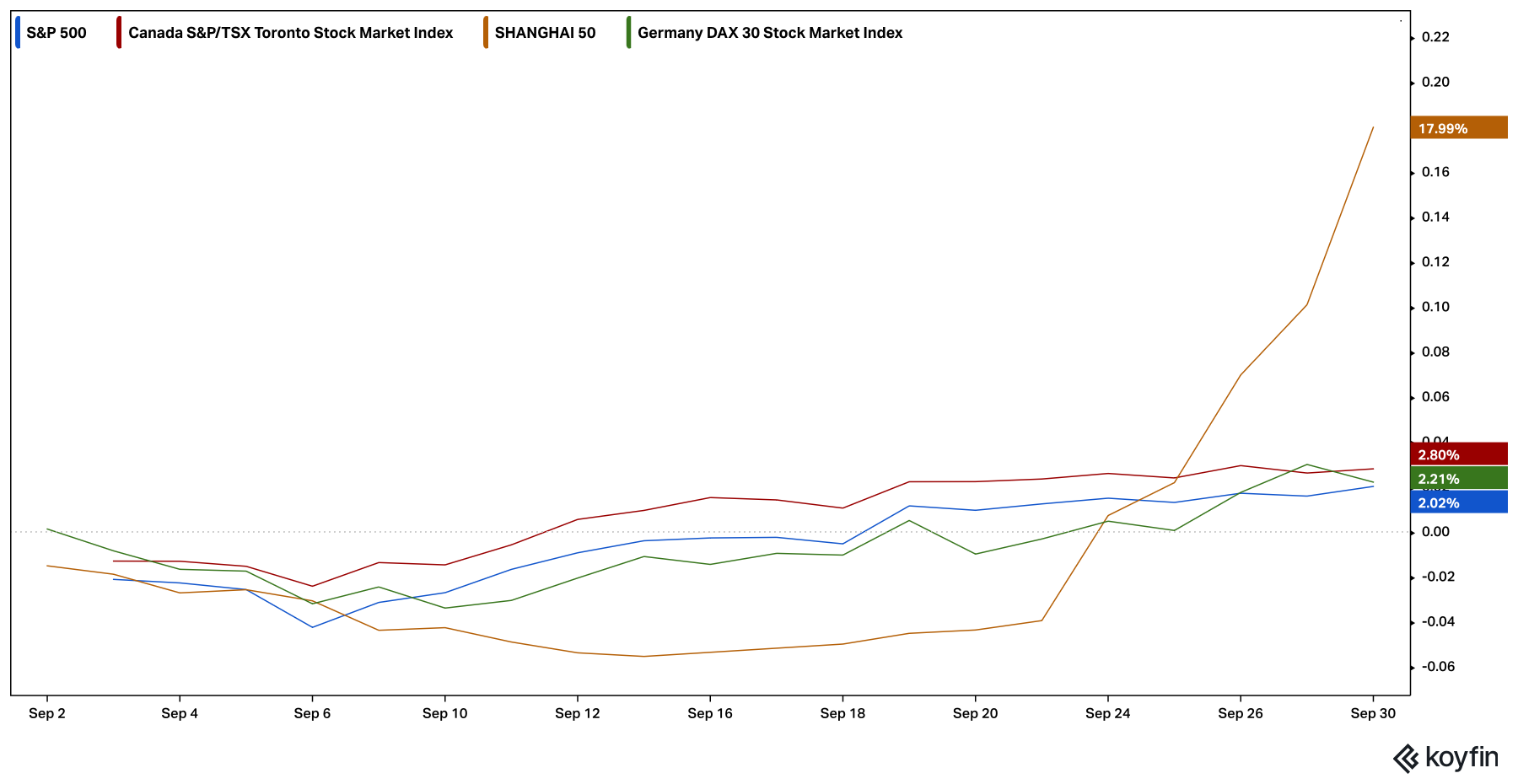

Monthly Market Analysis October 2024 Economy United States We are still not seeing any signs of a pending, prolonged economic slowdown in the United States. Last month, the U.S. job market produced 142,000 jobs and the unemployment rate fell from 4.3% to 4.2%. In August retail sales were up marginally, by 0.1%. Although, U.S. retail sales only slightly improved in August, the positive increase indicates that American consumers are still opening their wallets to spend. Consumer spending accounts for approximately 68% of economic activity (GDP) in the United States. On October 30th the third quarter GDP growth rate for the U.S. economy will be released. Canada Last month the Canadian job market rebounded from two consecutive months of job losses, with an increase of 22,100 jobs. The number of working age Canadians that are either working or looking for work increased last month, pushing Canada’s labour force participation rate higher by 0.1%. The higher labour force participation rate also helped push Canada’s unemployment rate to a three year high of 6.6%. After two months of declines, Canadian retail sales rebounded by 0.9% in July. Global Inflation Inflation is falling globally, and some countries may see deflation (negative inflation) over the next twelve months. China, which produces many of the consumer goods that we purchase in North America has an inflation rate of only 0.6%. Canada just hit the elusive 2% inflation target which most of the central banks, including the Bank of Canada, covet. The United States’ inflation rate has fallen to 2.5%. The Euro area inflation rate is below their 2% target and is now at 1.8%. Interestingly, Japan which experienced very low inflation and periods of deflation for most of the 21st century, currently has an inflation rate of 3%.  Markets North American markets experienced volatility but ended last month higher. The U.S. Market (represented by the S&P 500 index) increased by 2.02% in September, while the Canadian stock market (S&P/TSX Composite Index) improved by 2.79%. Last month, investors pushed the Shanghai Composite Index up by 17.39%, due to excitement about the Chinese government’s implementation of several strategies designed to stimulate their economy. Global Stock Markets (September 2024)  Last month, U.S. markets were driven by the Federal Reserve’s interest rate cut of 0.5%.The next U.S. Federal Reserve interest rate decision will be in early November. The Bank of Canada is expected to cut rates for a third straight meeting on October 23rd. Last month’s 0.5% rate cut in the United States may give the Bank of Canada more flexibility to trim rates by 0.5%, if it feels conditions warrant it. We are a little more than a month away from Election Day in the United States, but the political campaigns have had little impact on financial markets. With the American economy, gradually slowing down, it appears that both political candidates have focused their attention on strategies to stimulate the economy. 1 (Source: Bank of Canada) 2(Source: Statistics Canada) 3(Source: United States Bureau of Labour Statistics) 4(Source: United States Federal Reserve) 5(Source: United States Census Bureau) 6(Source: Koyfin as of September 30, 2024, 5:00 PM) | |||||

Desmond Rubie, BCom, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private WealthI nsurance Advisor | iA Private Wealth Insurance* 26 Wellington Street East, 2nd FloorToronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 Desmond.Rubie@iaprivatewealth.ca Schedule a Meetingrubiewealth.com This information has been prepared by Desmond Rubie, BCom, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc. IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. *Insurance products are provided through iA Private Wealth Insurance, which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund. |

Leave a Reply