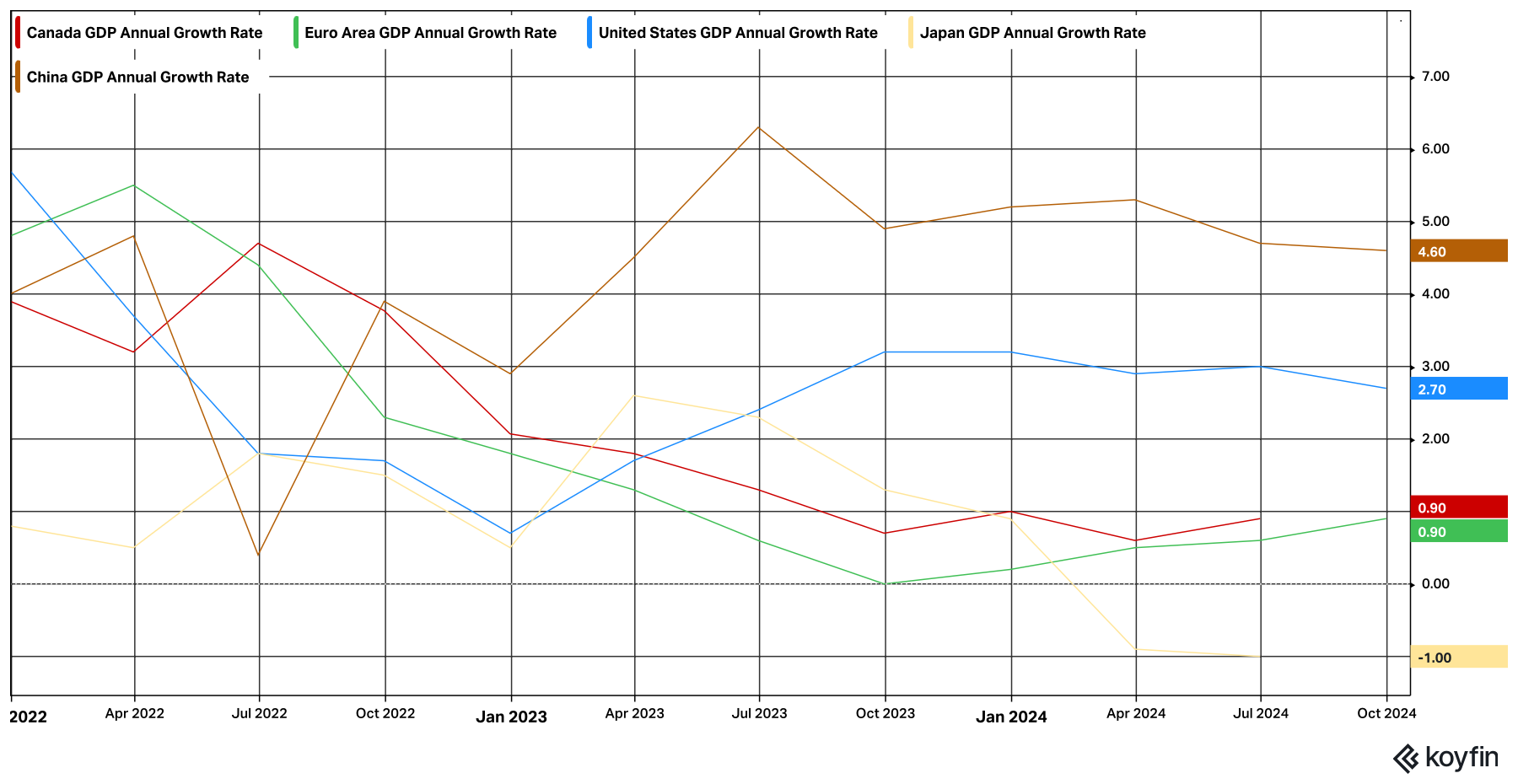

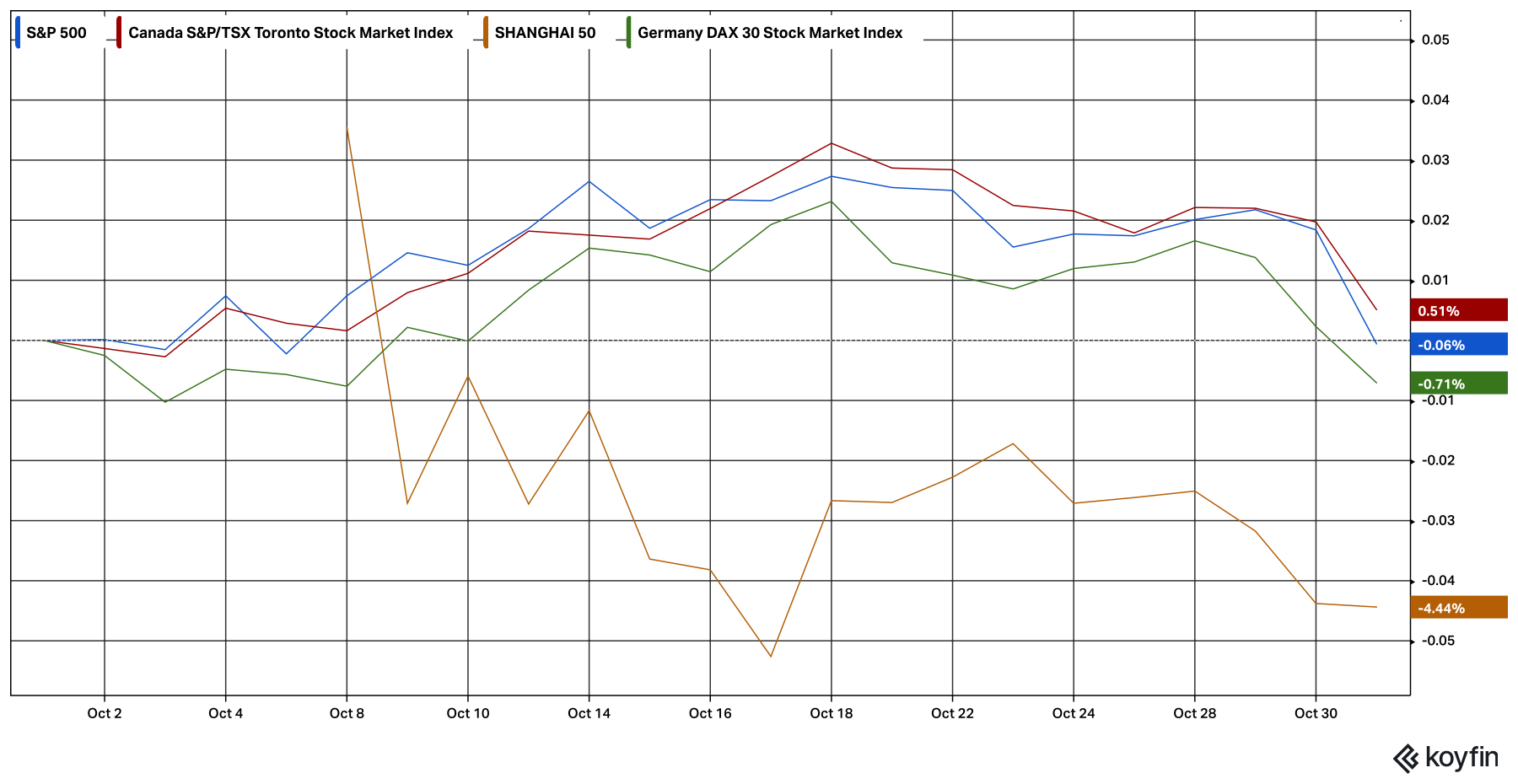

Monthly Market Analysis November 2024 Global Economy Where Do We Go from Here? In a global environment where most of the world’s central banks are cutting interest rates, inflation is trending downward, and economies are showing signs of rebounding. What can we expect next? Even with ongoing and developing, geopolitical headwinds, we expect the global economy to continue to rebound. As shown in the chart below: The U.S. continues to maintain a strong annual growth rate of 2.7%. Canada continues to stay out of recession territory with a 0.9% annual growth rate. The Eurozone economy has been rebounding from stagnancy and is seeing some marginal improvements in annual growth rate currently at 0.9%. China has seen a slowdown in economic growth bringing its annual growth rate to 4.6%, with no recent positive improvements. Japan’s economy fell into rapid decline and is currently experiencing a -1.0% annual growth rate.  United States The American economy had another strong showing of quarterly economic growth in the third quarter of 2024 as GDP grew by 2.8%. In September, the U.S added 234,000 jobs (revised), but recently released employment data (on November 1, 2024) showed that there were only 12,000 additional jobs generated in October. During the month of October hurricane activity across the U.S. may have negatively impacted the employment data, but we will get more insight when the U.S. Bureau of Labour Statistics releases November’s employment results on December 6th. American consumers continue their robust spending patterns as retail sales moved up 0.4% in last month’s release by the U.S. Census Bureau. U.S. inflation continues to drift downward, although the pace of decline is slower than Canada and many European countries have experienced. Last month, consumer inflation fell from 2.5% to 2.4% in the United States. Canada In the second quarter of 2024 the Canadian economy grew by 0.5%. Economists are expecting a slight improvement in growth in the third quarter to an estimated 0.6%. The pace of Canada’s economic growth as measured by the Quarterly GDP Growth Rate will be released by Statistics Canada on November 29th. Canada has seen an improvement in job growth over the last two months with 46,700 additional jobs in September, and 22,100 additional jobs in August. Inflation continues to fall in Canada. In September inflation fell from 2.0% to 1.6%. Falling inflation and a weaker economy provided the impetus for the Bank of Canada to reduce interest rates by 0.5% last month. Canadian consumers continue to open their wallets. Retail sales improved by 0.4% in August, which is the third consecutive month of growth. Maybe we’re going to have a good Christmas, after all. Markets Last month the Canadian (S&P/TSX Composite Index) stock market was up by 0.65%, while the U.S. (S&P 500 Index) equity market was down -0.99%. The Chinese market (Shanghai Composite Index) was down -1.70% and the German market (Dax 30 Index) was down -1.28%. Last month’s stock market volatility was driven by concerns about decreased profitability expectations for U.S. companies, as well as speculation about unfavourable economic outcomes based on which presidential candidate wins the U.S. election. Global Stock Markets (October 2024)  On Thursday, November 7th the U.S. Federal Reserve is highly anticipated to lower interest rates by 0.25%. The news conference after the interest rate announcement will likely drive market activity for several days as investors speculate on the path of future rate cuts. The U.S. Election on November 5th will also have a temporary impact on market activity. Investors will try to determine the impact that the Elections’ outcome will have on the U.S. and the global economy. The real impact of the U.S. Election results and its corresponding policy outcomes on the global economy, will be felt over the coming months and years. Although, the U.S. markets usually respond positively over time; whichever U.S. political party is in power. 1 (Source: Bank of Canada) 2(Source: Statistics Canada) 3(Source: United States Bureau of Labour Statistics) 4(Source: United States Federal Reserve) 5(Source: United States Census Bureau) 6(Source: Koyfin as of October 31, 2024, 5:00 PM)  Desmond Rubie, BCom, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private Wealth Insurance Advisor | iA Private Wealth Insurance* 26 Wellington Street East, 2nd Floor Toronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 Desmond.Rubie@iaprivatewealth.ca Schedule a Meeting rubiewealth.com *This information has been prepared by Desmond Rubie, BCom, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc. *IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. |

Leave a Reply