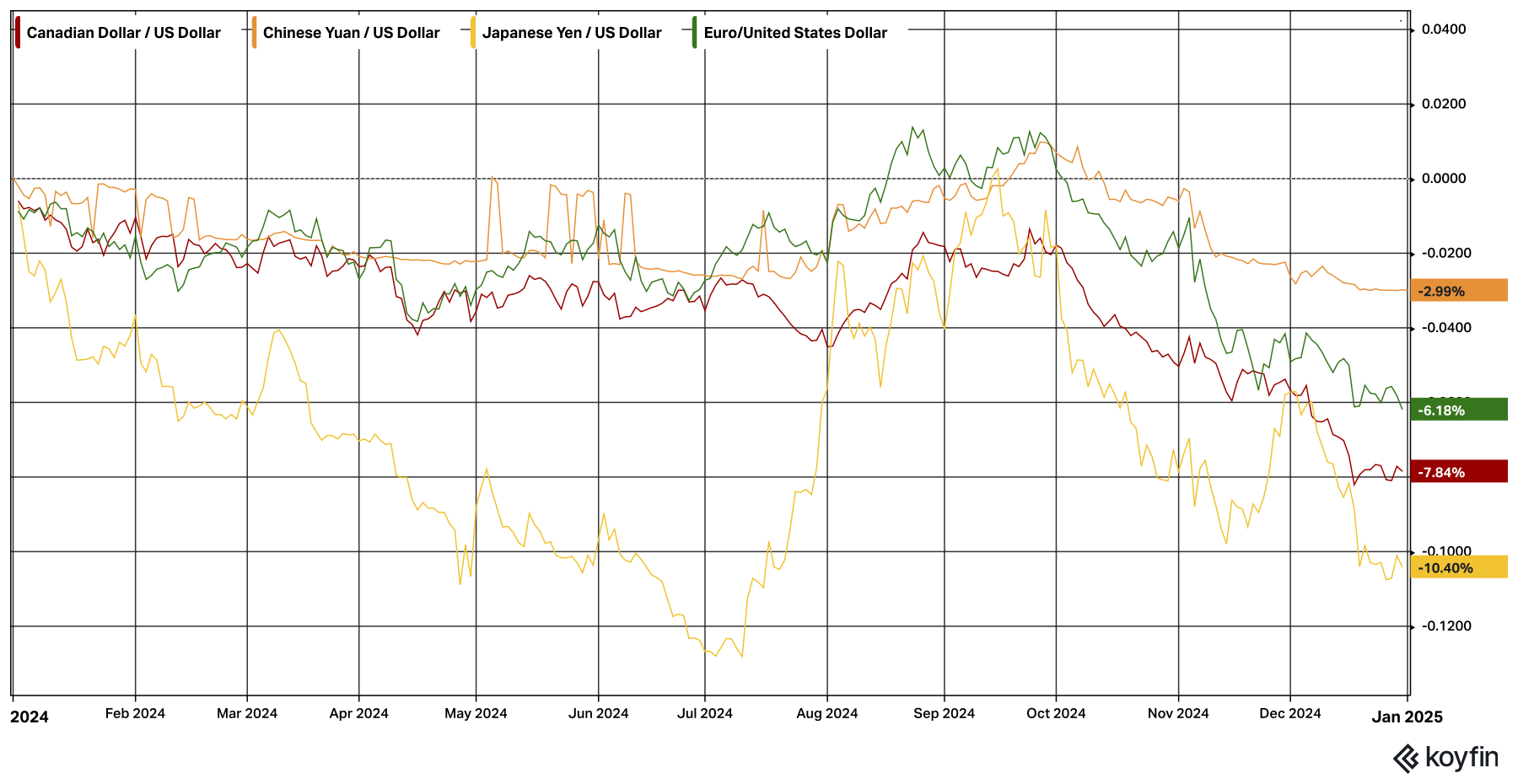

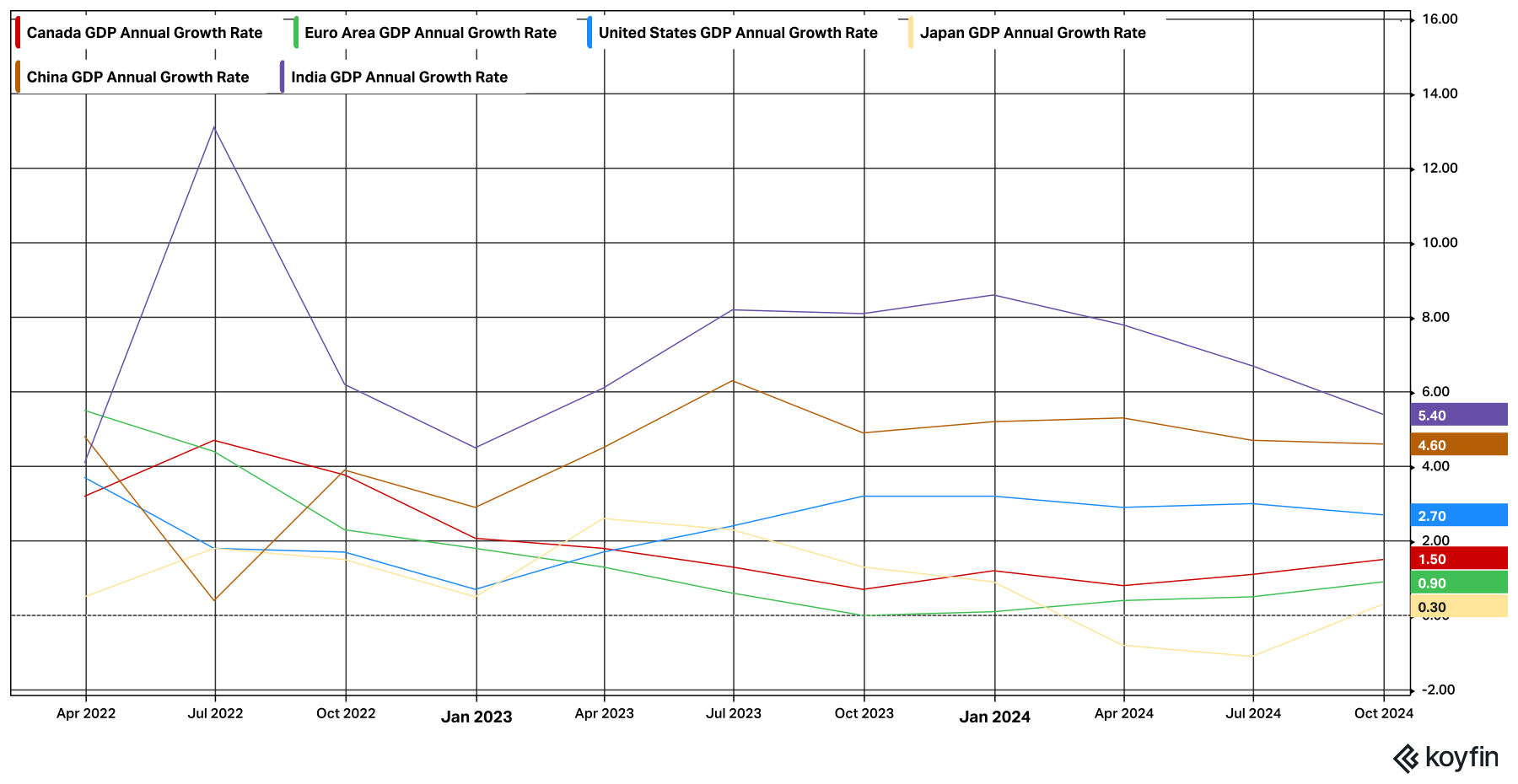

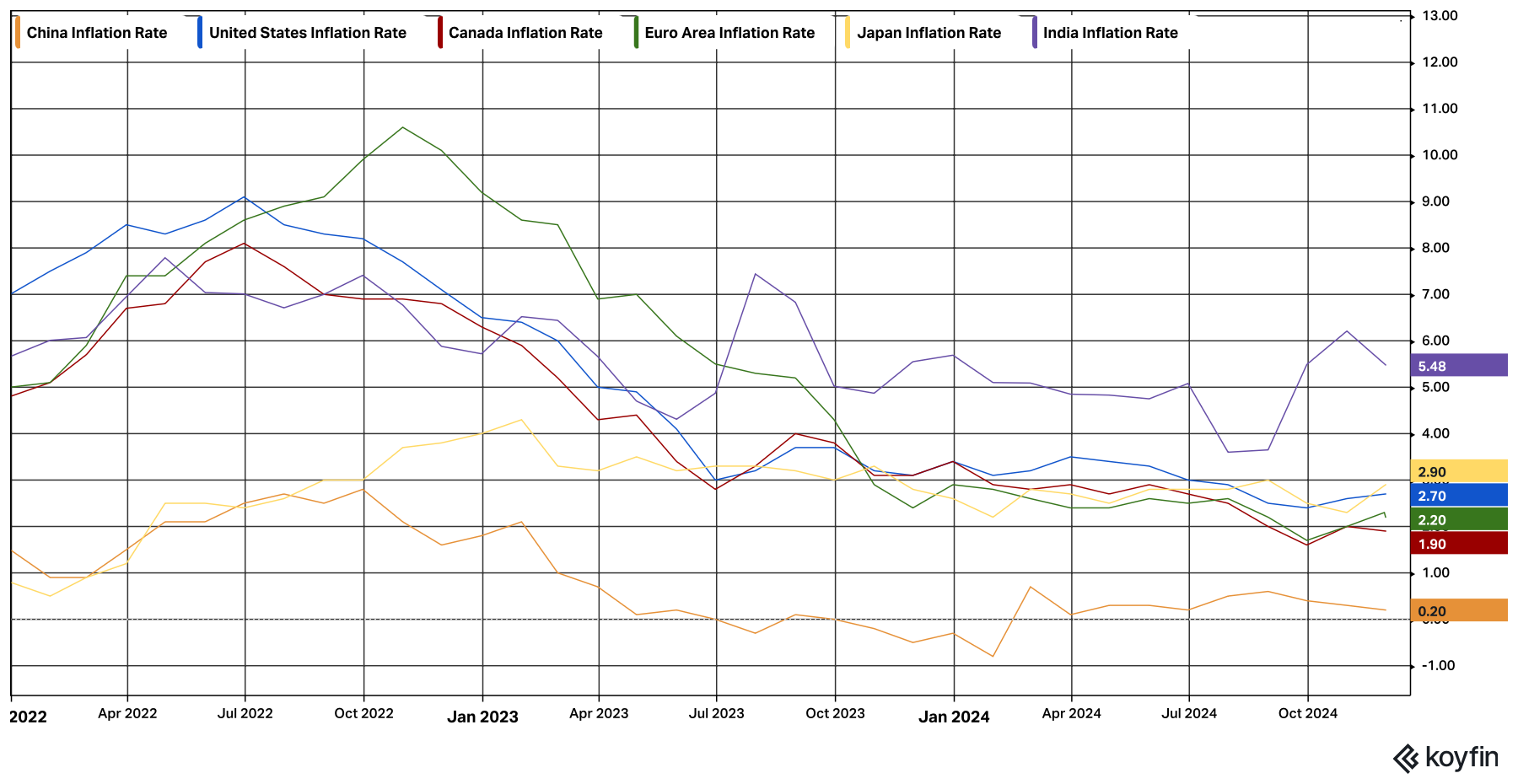

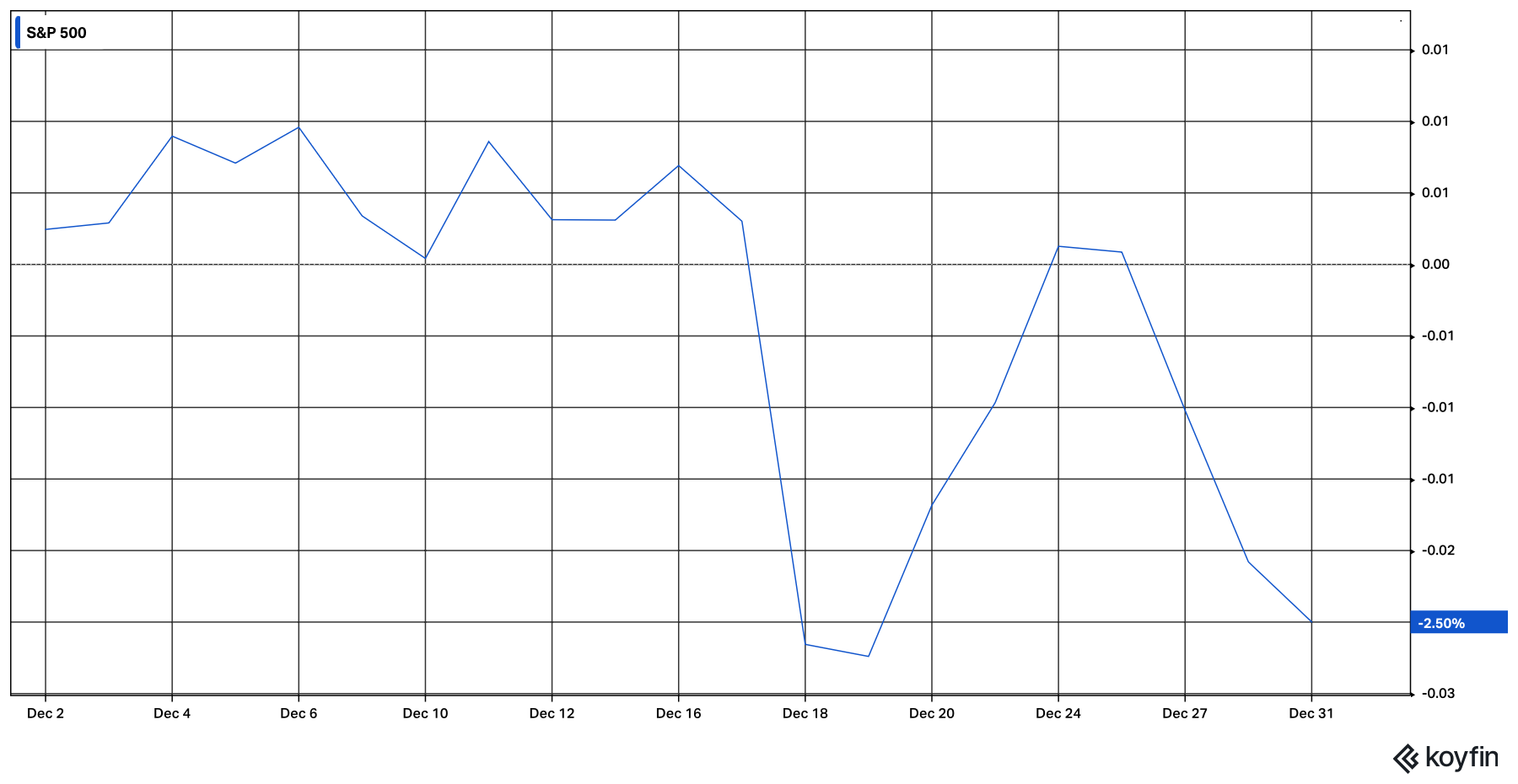

Monthly Market Analysis January 2025 Global Economy In 2024, several economic trends persisted: a strong U.S. Dollar; falling inflation; minimal economic growth in developed nations (except for the United States), Moderating economic growth in developing nations (see charts below). We will continue to monitor these trends in 2025, but we can expect some changes. 2025 Expectations The U.S. Dollar will likely see additional volatility, due to the expected trade negotiations that the incoming Trump Administration has promised. Inflation has either achieved or is very close to achieving the 2% target, desired by most central banks. Although, we may see inflation continue to bounce up and down as commodity prices continue to be impacted by global geopolitical conflicts (the price of natural gas increased by 55.86% in 2024). But disinflation may get some help in the second half of 2025, as consumer goods companies bring down prices to win back customers that stopped buying their goods due to previous price hikes. Global Currencies Most global currencies fell in value versus the U.S. Dollar last year, including the Canadian Dollar which fell by 7.84%.  Global Growth (GDP) The U.S. is leading many developed nations in economic growth with an annual GDP growth rate of 2.7%. Canada’s annual GDP growth rate of 1.5% outperforms the Eurozone and Japan. China is seeing a sharp decline in the growth of its economy, while India’s economy is gradually moderating.  Global Inflation Rates Inflation fell dramatically over the last three years, but the decline moderated in 2024. Inflation in most developed countries is below 3%.  United States Overall economic conditions in the United States are still positive. The latest review of economic growth by the U.S. Bureau of Analysis determined that U.S. third quarter GDP growth for 2024 was better than they previously estimated, leading them to revise the third quarter’s rate of growth from 2.8% to 3.1%. The initial estimate for fourth quarter GDP will be released on January 30th. As expected, the U.S. job market rebounded in November, generating 227,000 additional jobs, compared to the hurricane impacted low of 36,000 (revised) additional jobs generated during October. The U.S. unemployment rate moved up in November from 4.1% to 4.2%. Last month, the U.S. Federal Reserve, lowered the Federal Funds Rate by 0.25% to 4.50%, which will provide additional stimulus to the U.S. economy. Expectations are that the U.S. Federal Reserve may decide to take a pause from lowering interest rates when they meet on January 29th. In November, American consumers continued to spend as retail sales increased by a strong 0.7%. Canada It should be noted that, although the Canadian economy is underperforming the United States, with an annual GDP growth rate of 1.5%; the Canadian economy is outperforming the Eurozone and many other G8 countries. The Canadian labour market painted a mixed picture last month, when 50,500 additional jobs were generated, while the unemployment rate increased from 6.5% to 6.8%. Last month’s higher unemployment rate, combined with the decline in the inflation rate, provided motivation for the Bank of Canada to lower interest rates by 0.5%, from 3.75% to 3.25%. Consumer spending in Canada increased in November as retail sales increased by 0.6%. Markets Last month North American markets were down as equity market investors digested changes in the interest rate outlook for the U.S. Federal Reserve and the realization that some of the upcoming Trump Administration’s policies may not automatically reap positive economic benefits. The U.S equity market (S&P 500) was down -2.5% and the Canadian stock market (S&P/TSX Composite Index) fell by – 3.59%. The beginning of December was relatively flat for the U.S. stock market, but after the Federal Reserve’s interest rate meeting on December 18th the market fell sharply. During the press conference following the meeting, Federal Reserve Chairman Jerome Powell indicated a lower amount of rate cuts in the committee’s 2025 outlook than had previously been expected. U.S. stock market investors also appeared to react to daily news items pertaining to the perceived challenges the incoming Trump Administration is likely to face as the Inauguration date approaches (January 20th). The realization that the new U.S. administration will have to seek approval from Congress for many of their policy initiatives is beginning to dawn on U.S. stock market participants. The difficulty that the incoming Trump Administration has had with getting some Cabinet nominees approved, and December’s drawn-out fight to avoid a government shutdown, suggest that it will not be easy to push through all of their policies. In the coming weeks, the speculation will end, as we begin to see the new Trump Administration execute on their promised policy initiatives. U.S. Stock Market (S&P 500) – December 2024  1 (Source: Bank of Canada) 2(Source: Statistics Canada) 3(Source: United States Bureau of Labour Statistics) 4(Source: United States Federal Reserve) 5(Source: United States Census Bureau) 6(Source: Koyfin as of December 31, 2024, 5:00 PM)  Desmond Rubie, BCom, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private Wealth Insurance Advisor | iA Private Wealth Insurance* 26 Wellington Street East, 2nd Floor, Toronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 Desmond.Rubie@iaprivatewealth.ca Schedule a Meeting rubiewealth.com * This information has been prepared by Desmond Rubie, BCom, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc. IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. *Insurance products are provided through iA Private Wealth Insurance, which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund. |

Leave a Reply