Economy

United States

The United States’ labour market continued its recent trend of anemic job growth, with only 50,000 jobs being generated in December. December’s U.S. unemployment rate fell slightly from 4.5% to 4.4%, primarily due to a reduction in the size of the labour force during the month.

U.S. consumers were more generous with their spending in November as retail sales grew by 0.6%.

The U.S. Inflation rate remained at 2.7% for a second consecutive month in December. December’s inflation rate was driven by rising food and shelter costs and moderated by falling gasoline and automobile prices.

The U.S. Federal Reserve continues to be dually concerned with inflation rates above their 2% target as well as slowing job growth. In their December meeting, the Federal Reserve decided to cut interest rates by another 0.25%, bringing the Federal Funds Rate to 3.75%. The U.S. Federal Reserve will meet again on Wednesday (January 28th) for another interest rate meeting, but most market participants and economists expect that they will leave the Fed Funds rate at the current level.

Canada

The Canadian economy continues to generate jobs at a strong pace. Although the 8,200 jobs generated in December were not as high as the 53,600 jobs generated in November, it was still a strong month given the size of the Canadian labour market. The Canadian unemployment rate discontinued the downward path it had been following over the last two months as it rose from 6.5% to 6.8% in December. One of the primary reasons the unemployment rate rose in December was the expansion of Canada’s labour force by an additional 81,000 people. The addition of 81,000 people searching for work negatively impacted the unemployment rate.

Last minute Christmas shoppers were scarce in December as Canadian retail sales fell by -0.5% after growing by 1.2% in November. Retail spending in Canada has shown a pattern of being positive one month and then down the following month for most of 2025.

The Canadian inflation rate increased from 2.2% to 2.4% in December, moving further away from the Bank of Canada’s 2% target. The Bank of Canada is not worried about runaway inflation and expects that inflation will move toward their target rate over the coming months. After maintaining rates at 2.25% in their last meeting, the Bank of Canada is expected to leave rates unchanged again when they meet on Wednesday (January 28).

Markets

Global Stock Markets

During the month of December, the U.S. Market (S&P 500) was slightly down by -0.05%, while the Canadian market (S&P/TSX Composite Index) continued its strong pace and grew by 1.05%. The U.S. Nasdaq Composite index which contains a high weighting of technology related stocks decreased by -0.53%. The German stock market (Dax 40 index) had a very strong month and was up by 2.74%. The Chinese market (Shanghai Composite Index) grew by 2.06% and the Indian market (Nifty 50 Index) fell by -0.28%.

Change in Global Stock Markets the Month of December 2025

Source: FactSet®

So far in January, we have experienced volatility in global stock markets due to new tariff threats and military operations instigated by the Trump administration. Investors and governments have been moving money into safe haven assets, such as gold, which has grown by 8.42% so far in 2026, after a 64.05% increase in 2025. The latest geopolitical conflicts in Venezuela, Greenland, and Iran have had little impact on equity markets, but have triggered upward movement in commodity and precious metal markets. Trump threatening additional tariffs on Europe, Canada, and other nations have had minimal market impact as market participants have seen many of the previous Trump tariff threats rescinded or withdrawn.

In the coming weeks or perhaps days, the U.S. Supreme Court is expected to decide on the legality of the Trump’s tariffs enacted under the International Emergency Economic Powers Act. The eventual announcement of the legality of the Trump tariffs by the Supreme Court will likely trigger a market reaction. If the tariffs are determined to be illegal, it is likely to provide a temporary positive jolt for markets, whereas a ruling allowing the tariffs to stand may have a muted market reaction (since that is the current status quo).

Corporate earnings season has started off with many financial companies reporting positive earnings growth. As other sectors/industries report over the coming weeks expectations are that companies in economically declining sectors, such as retail will continue to be under earnings pressure.

Global Annual GDP Growth Rates after Trump’s Tariffs

Declining Economies (among the six economies in our tracking)

| Change in Economic Growth after Trump’s Tariffs | |

| United States | -0.2% |

| Canada | -0.9% |

| China | -0.9% |

| Japan | -0.2% |

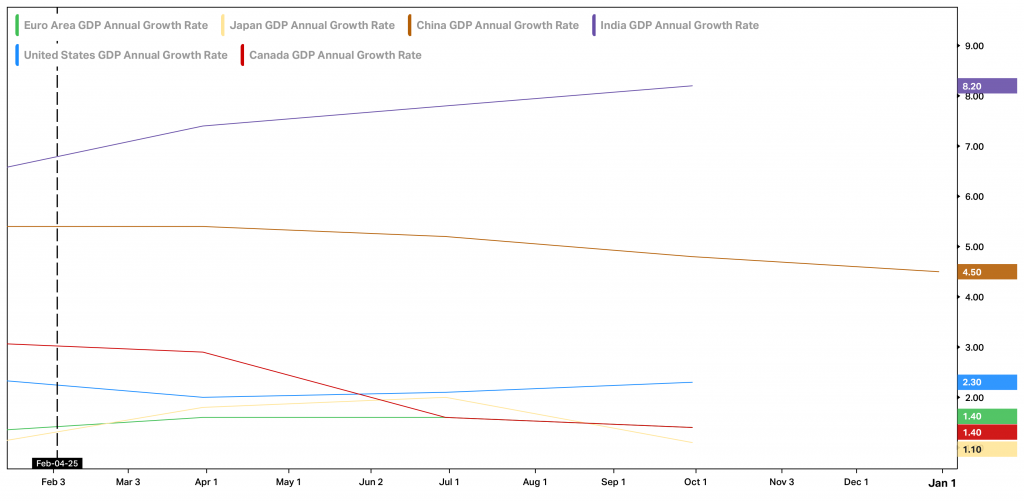

Global Economic Growth (Annual GDP Growth Rate) – 1 Year Chart (*Dotted line shows the start of Trump’s Tariffs, February 4th)

The U.S. economy’s (blue) annual growth rate declined from 2.5% to 2.3%. The Canadian economy’s (red) annual growth rate declined from 2.3% to 1.4%. China’s annual economic growth rate (brown) fell from 5.4% to 4.5%. The Japanese annual economic growth rate (yellow) declined from 1.30% to 1.10%. The Eurozone’s annual economic growth rate (green) increased from 1.2% to 1.4%. India’s annual economic growth rate (purple) improved from 6.4% to 8.2%.

Source: Koyfin

Global Annual Inflation Rates after Trump’s Tariffs

Rising Inflation (among the six economies in our tracking)

| Economies with Rising Inflation after Trump’s Tariffs | |

| Canada | +0.5% |

| China | +0.3% |

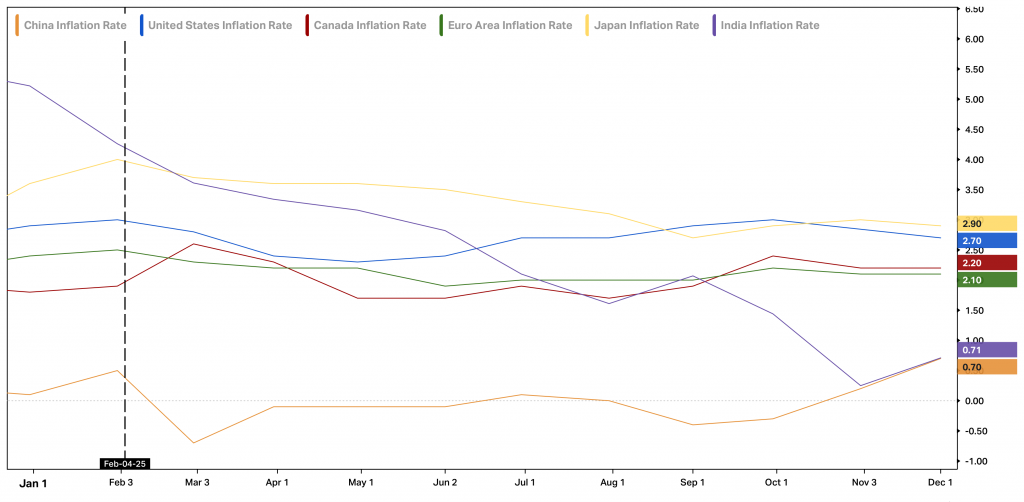

Global Inflation Rates (Annualized) – 1 Year Chart (*Dotted line shows the start of Trump’s Tariffs, February 4th)

Since Trump’s Tariffs were implemented the inflation rate for all the tracked economies have moved lower except Canada and China. Canada’s inflation rate (red) increased from 1.9% to 2.4%. China’s inflation rate (orange) increased from 0.5% to 0.8%.The United States’ inflation rate (blue) declined from 3.0% to 2.7%. The Eurozone inflation rate (green) fell from 2.5% to 1.9%. Japan’s inflation rate (yellow) decreased from 4.0% to 2.1%, and India’s inflation rate (purple) fell from 4.26% to 1.33%.

Source: Koyfin

1 (Source: Bank of Canada)

2(Source: Statistics Canada)

3(Source: United States Bureau of Labour Statistics)

4(Source: United States Federal Reserve)

5(Source: United States Census Bureau)

6(Source: FactSet as of December 31, 5:00 PM)

* This information has been prepared by Desmond Rubie, BCom, FCSI®, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, FCSI®, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc.

*IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

Desmond Rubie, BCom, FCSI®, CIM®, CFP®

Wealth Advisor

Rubie Wealth Management Group | iA Private Wealth

Insurance Advisor | iA Private Wealth Insurance*

26 Wellington Street East, 2nd Floor

Toronto, ON M5E 1S2

T: 647-429-3281 ext. 240018 | M: 416-795-6100

Desmond.Rubie@iaprivatewealth.ca

Fellow of CSI (FCSI®)

iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

*Insurance products are provided through iA Private Wealth Insurance, which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund.

Leave a Reply