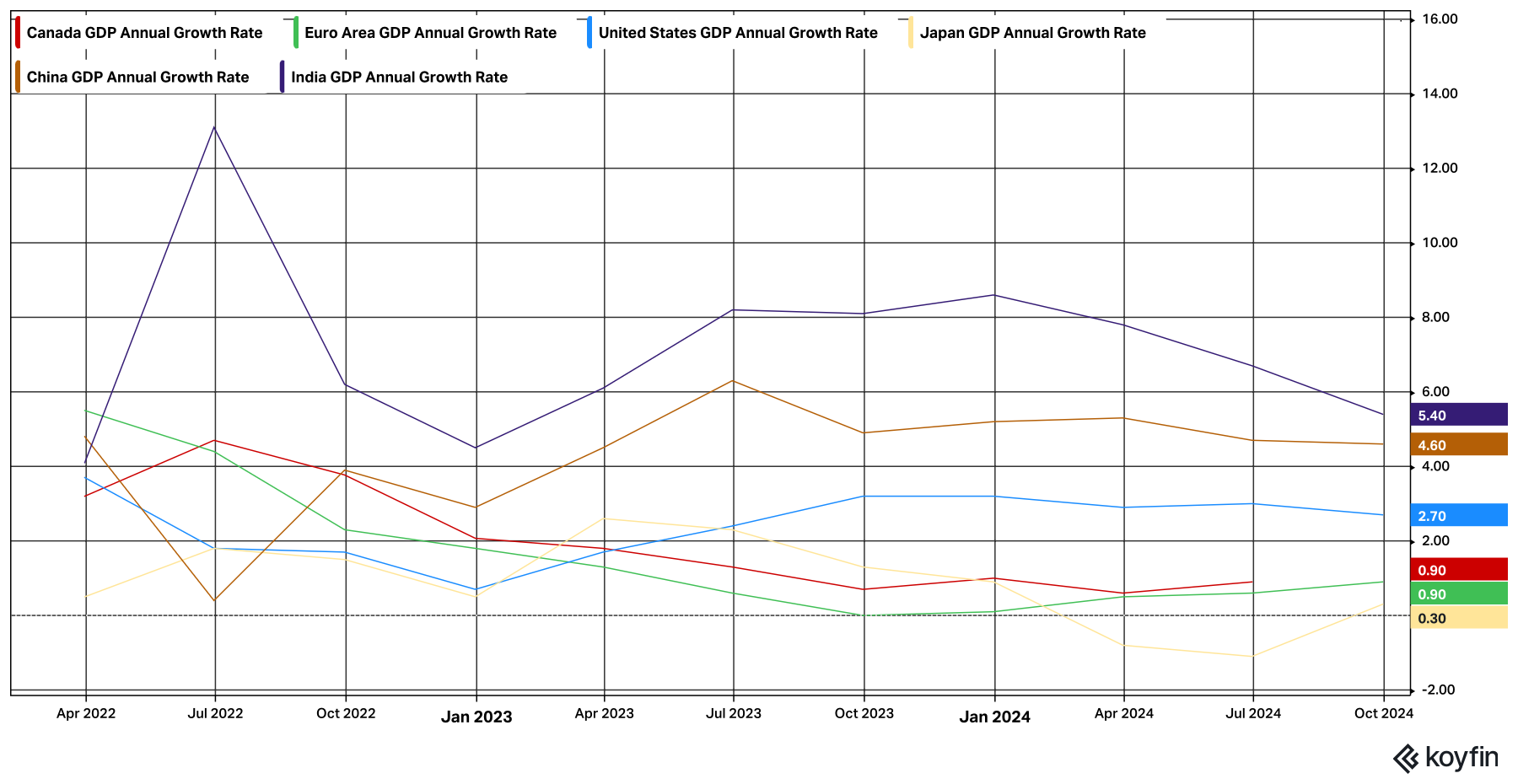

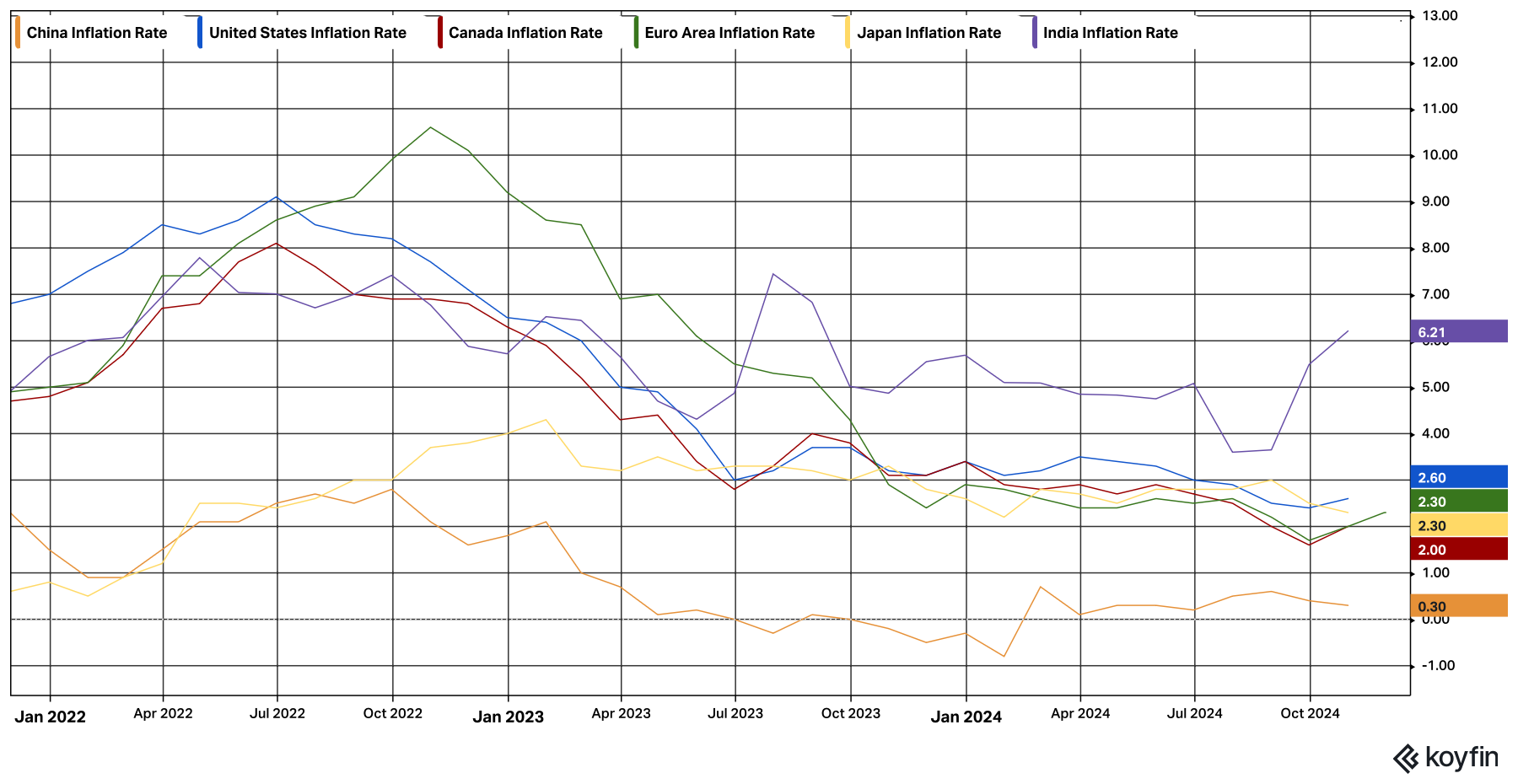

Monthly Market Analysis December 2024 Global Economy Unpredictability Although the purpose of this article is not to analyze government policies, it is necessary to reflect on the changing political environment in the United States. The proposed changes to U.S. Government policy will lower corporate taxes, increase tariff rates, and widen the number of countries that are charged tariffs on goods imported into the country. Given the large shadow the United States casts globally, these new policies will impact economies around the world. During the earlier stages when the new policies are implemented the economic outlook will be cloudy, but eventually over time the economic impact will become clearer. Certainly, there will be winners and losers in this new economic environment, it’s just too early to make those types of predictions. Overview Despite the unfortunate, geopolitical tensions in Ukraine, the Middle East and Africa, many countries around the globe are experiencing growth in their economies (albeit, quite minimal in some cases). Inflation is still an ongoing concern but has lost its intensity. Many companies are reporting that consumers are taken aback by the “sticker shock” of how high prices have risen since the beginning of 2020. A great example of this is McDonalds’ new strategy to reintroduce “value meals” onto their restaurant menus, due to customer dissatisfaction with the current high prices of their menu items. Global Growth (GDP) As shown in the chart below: The U.S. annual growth rate is 2.7%. Canada’s annual growth rate is 0.9% (for the period ending in Q2 2024). The Eurozone is currently growing at a rate of 0.9% annually. China’s growth continues to slow and is now at 4.60%. The Indian economy has also slowed and is currently growing at an annual rate of 5.4%. The Japanese economy has reversed a negative growth trend and is now growing at 0.3% annually. Correction: Last month the growth rate for the Eurozone and Canada was stated as 0.5%. The correct rate was 0.9% – as was shown in the graph.  Global Inflation Rates As shown in the chart below: Global inflation shifted higher last month. The U.S. inflation rate moved up from 2.4% to 2.6%. Canada’s inflation rate grew from 1.6% to 2.0%. The Eurozone’s inflation rate increased from 2.0% to 2.3%. China’s inflation rate moved down to 0.3%. India’s rate of inflation spiked upward to 6.21%. Japan’s inflation rate came down from 2.5% to 2.3%.  United States One area of the U.S. economy that has helped drive economic growth during the last three years is the strong job market. During the month of October, the United States added only 12,000 jobs (likely due to the impact of hurricanes and a labour strike during the month). Job growth is expected to rebound by 183,000 jobs in November. The November Jobs report will be released on December 6th; it will be highly scrutinized for any further weak job data. The unemployment rate was unchanged at 4.1%. Last month the U.S. Federal Reserve, provided additional relief to American borrowers by lowering the Federal Funds Rate by 0.25% to 4.75%. The U.S. Federal Reserve is expected to lower rates by another 0.25% when they meet again on December 18th. Canada In the third quarter of 2024, the Canadian economy grew by just 1% compared to 2.2% in the previous quarter. Higher interest rates have had a negative impact on the Canadian housing market, but with the recent Bank of Canada rate cuts we are starting to see an improvement in housing construction. Housing starts in Canada (new housing construction) recently peaked at 321,284 units in May 2021. In October of this year Housing Starts were only 240,800 units, but that is an improvement over September’s 223,400 units. Canadian consumers continue to shop as retail spending increased by 0.4% in September. Canada’s Household Savings Rate in the second quarter of this year was a healthy 7.6%, well above the 2.8% level achieved before the start of the pandemic (fourth quarter of 2019). On the other hand, Statistics Canada estimates that consumer credit in Canada reached an all-time high of $776 Billion Dollars in the second quarter of this year. The Canadian economy produced 14,500 jobs in October, the third consecutive month of positive job growth. The unemployment rate was unchanged at 6.5%. The Bank of Canada is expected to lower rates by 0.25% at their interest rate policy meeting on December 11th. Markets Last month the Canadian stock market (S&P/TSX Composite Index) was up by 4.42% The U.S. market (S&P 500 Index) grew by 3.42%. The German (Dax 30), French (CAC 40) and Chinese (Shanghai Composite) equity markets improved marginally at 0.76%, 0.82%, and 1.22%, respectively. The election of Donald Trump as U.S. President provided additional excitement to an already enthusiastic U.S. stock market. Many, U.S. stock market investors believe that the incoming U.S. President’s promises to cut corporate taxes, and lower government regulations will result in stronger economic growth. 1 (Source: Bank of Canada) 2(Source: Statistics Canada) 3(Source: United States Bureau of Labour Statistics) 4(Source: United States Federal Reserve) 5(Source: United States Census Bureau) 6(Source: Koyfin as of October 31, 2024, 5:00 PM)  Desmond Rubie, BCom, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private Wealth Insurance Advisor | iA Private Wealth Insurance* 26 Wellington Street East, 2nd FloorToronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 Desmond.Rubie@iaprivatewealth.ca Schedule a Meeting rubiewealth.com * This information has been prepared by Desmond Rubie, BCom, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc.IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. *Insurance products are provided through iA Private Wealth Insurance, which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund. |

Leave a Reply