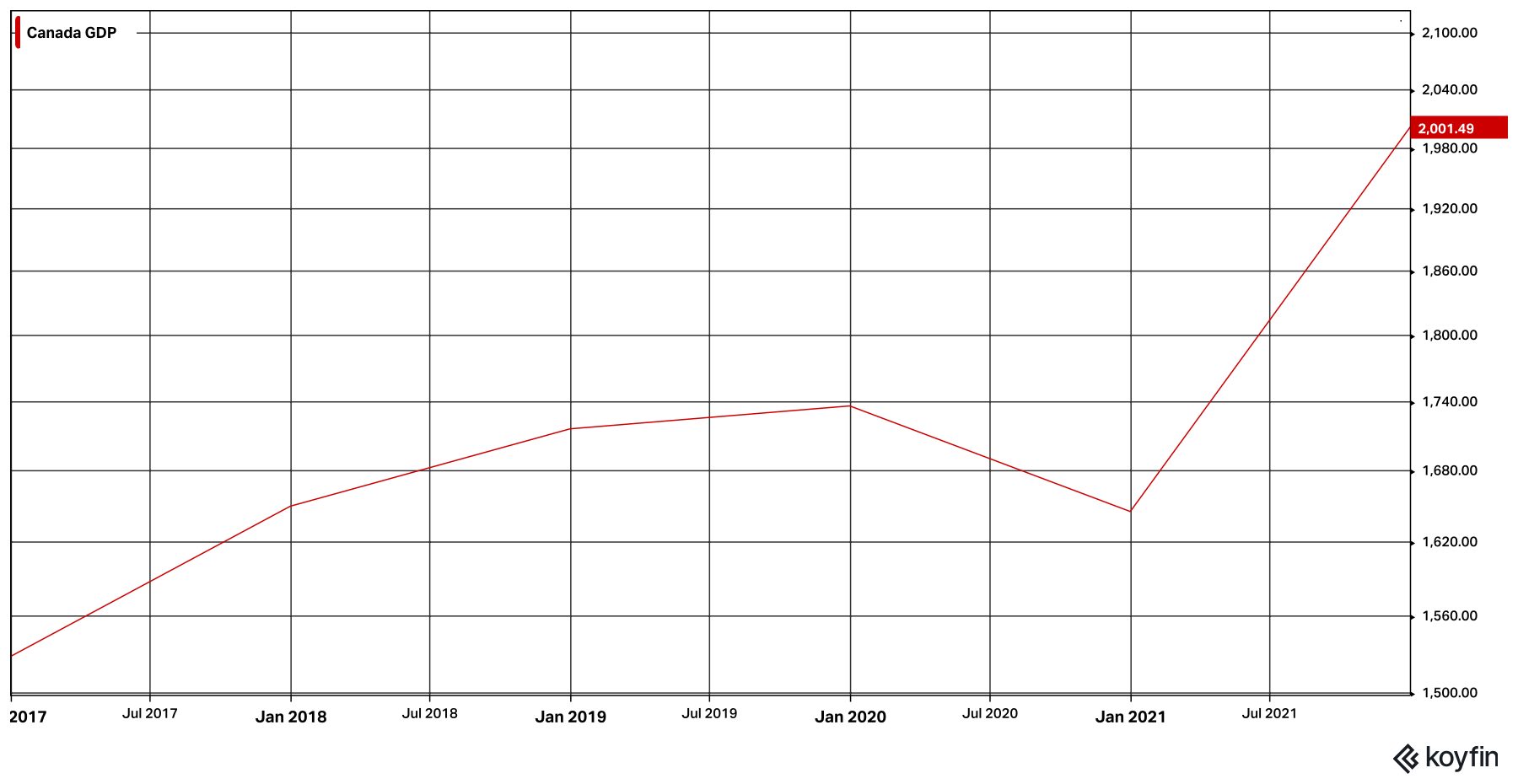

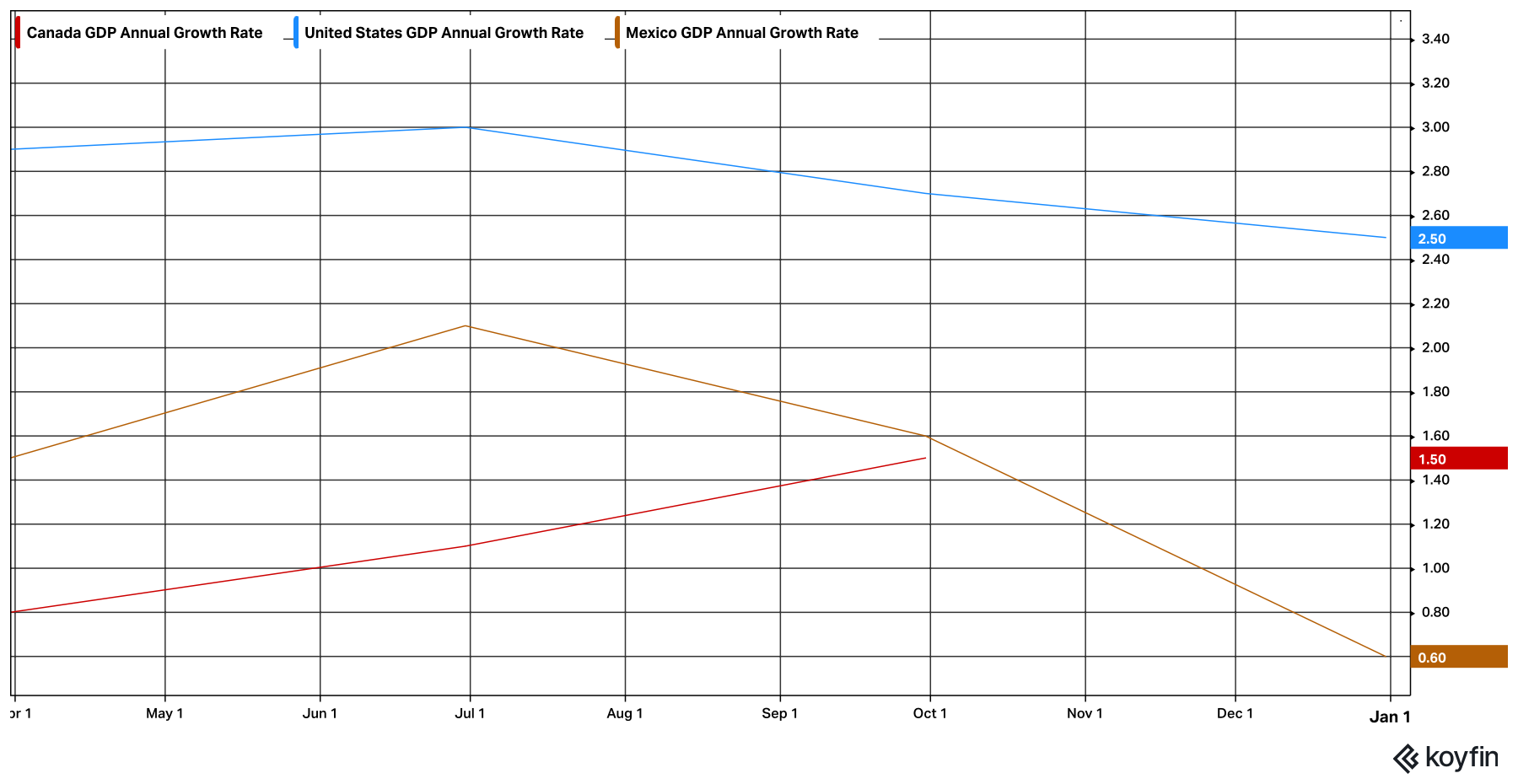

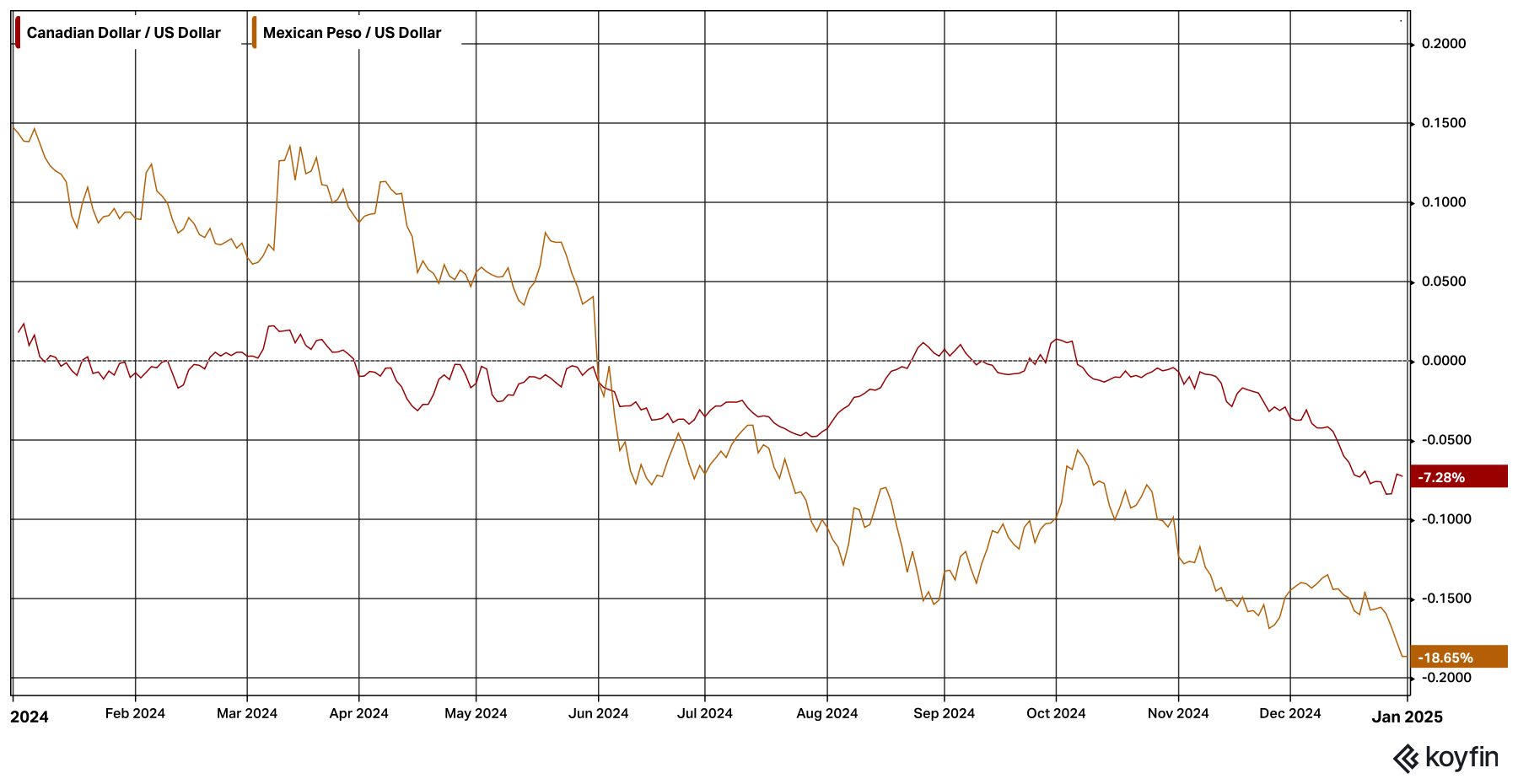

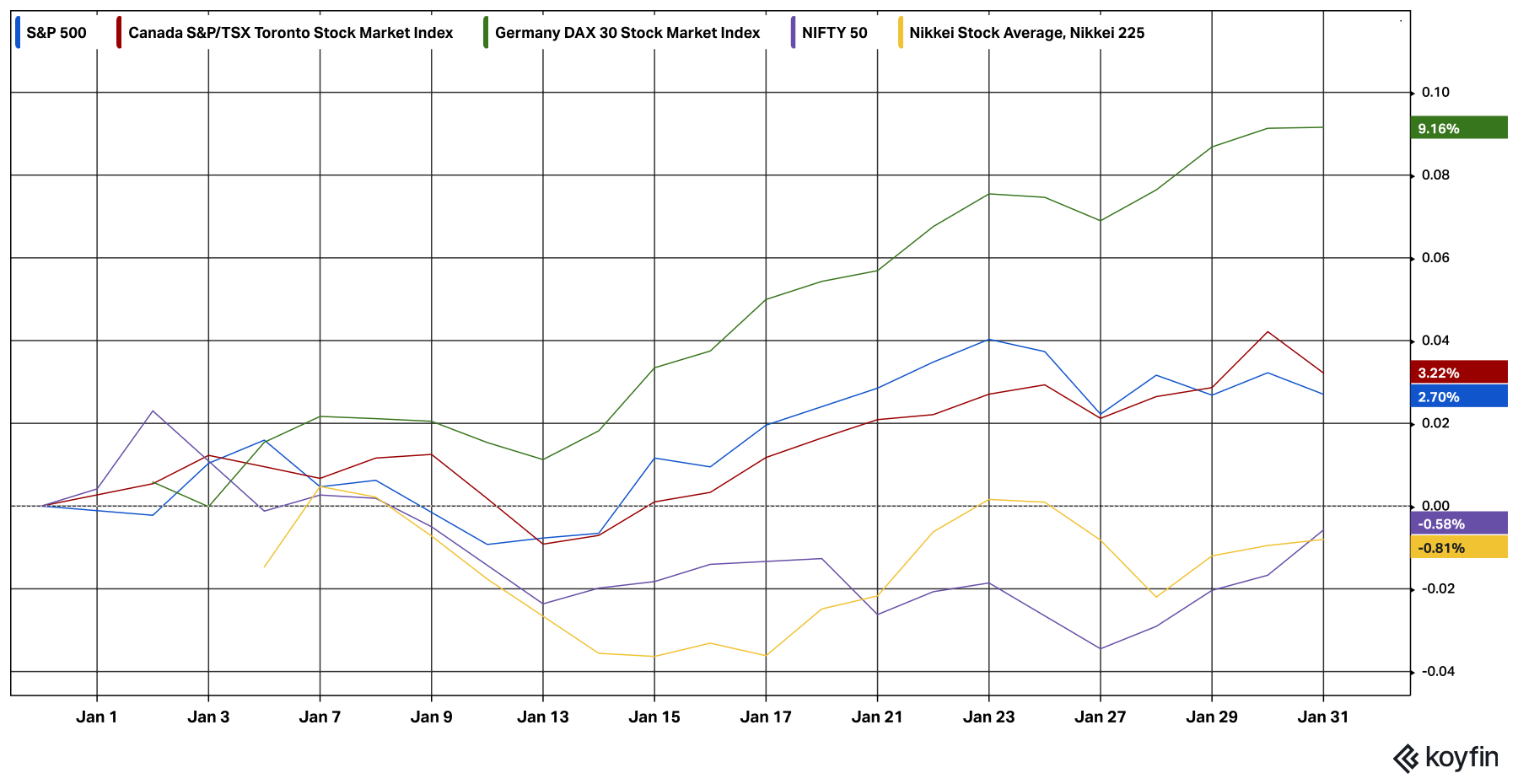

Monthly Market Analysis February 2025 Economy Tariffs The United Nations (COMTRADE) estimates that in 2017, the first year of the Trump presidency, Canada exported $319 billion USD to the United States. By 2021, one year after Trump left the White House, Canadian exports to the United States were $378 billion USD. Most recently, in 2023, Canada exported $440 billion USD to the United States. During the first Trump administration the Canadian economy grew from 1.65 trillion USD to $2.01 Trillion USD (World Bank), while at the same time, it overcame two major economic shocks: the COVID-19 pandemic and the first Trump administration’s trade war. The Canadian economy may experience short-term turbulence, but it will once again overcome another Donald Trump trade war. Canadian GDP (2017-2021)  As new tariffs are introduced by the Trump administration and retaliatory tariffs are enacted by the Canadian Government in response, companies in both countries will have to determine whether they can absorb the cost of these tariffs or whether they can pass the cost on to the consumer. In many cases North American businesses will be forced to increase prices on their goods, inflicting further economic pain on consumers already frustrated with current price levels. It should also be noted that the elevated price levels that North American consumers are currently experiencing was partially triggered by the economic effects of the government’s COVID-19 pandemic policy of business closures and subsequent reopening, which resulted in service and supply chain bottlenecks. Tariff Duration It is uncertain exactly how long the Trump tariffs will be in force, but several possible scenarios may decide the eventual duration: Legal: The imposition of Trump’s tariffs often contravenes international trade law, but enforcing these laws can be a long, tedious process sometimes with no viable remedies. American industries that are impacted by Trump’s tariffs often have lobby groups that can challenge the legality of the Trump tariffs in U.S. courts. Retaliatory Tariffs: The negative impact of higher consumer prices in the United States and the unavailability of required/desired Canadian goods brought about by Canadian retaliatory tariffs may generate political backlash from U.S. consumers and businesses. Trade Negotiations: At any time, trade negotiations between Canada and the United States could end the trade war. American Political Environment: In twenty-two months (November 2026) U.S. Congressional Elections may change the political environment. If American voters are unhappy with how the Trump tariffs are impacting their lives, Republicans could lose their majority in Congress. End of Trump’s Term: In less than four years Donald Trump will complete his second term as the President of the United States of America. A new American President could undo the Trump tariffs, if they are still in place, or at the bare minimum change the political tone between Canada and the United States. North American GDP Growth Rate Prior to Tariffs Although the U.S. economy is growing at the fastest rate (2.5%) among its North American peers, its pace of growth has slowed in the last year. On the other hand, Canada’s economic growth rate has sped up from near zero to 1.5% (up to the 3rdquarter of 2024). Mexico’s economy is declining towards no growth at 0.6%.  North American Currencies The outperformance of the American economy combined with the relatively higher U.S. Federal Funds rate has strengthened the U.S. dollar. The Canadian dollar fell -7.28% against the U.S. Dollar in the last 12 months, while the Mexican Peso fell by -18.65% over the same period.  United States The U.S. economy’s positive job growth momentum has now been extended to four years as an additional 143,000 jobs were generated in December. Over the last four years, monthly employment growth peaked at 904,000 jobs in February 2022.The unemployment rate fell from 4.1% to 4.0% emphasizing the overall strength of the U.S. labour market. U.S. monthly retail sales grew by 0.4% in the latest month of data. Consumer spending continues to grow as the rate of inflation is on an upward trend, moving up from 2.7% to 2.9%. December’s increase in inflation is the fourth consecutive month that inflation has inched upward. January’s inflation data will be released on February 12th. The quarterly GDP growth rate for the last quarter of 2024 fell to 2.3%, the previous quarter’s growth rate was 3.1%. The U.S. Federal Reserve decided to hold the Federal Funds rate steady at 4.5% in their interest rate meeting last month. Canada In January, Canada generated an additional 76,000 jobs, the third consecutive month of astronomical job growth. The unemployment rate fell from 6.7% to 6.6%. Canada’s Santa Claus came to town in December as retail sales grew by 1.6% during the month. Canada’s Inflation rate fell in December from 1.9% to 1.8%, the third consecutive monthly decline. Another positive economic development in Canada occurred on January 29th, when the Bank of Canada reduced the overnight interest rate from 3.25% to 3.0%. Markets Global stock markets had a positive month in January. In North American the Canadian market (S&P/TSX Composite Index) was up 3.26% and the U.S. market (S&P 500) was up 2.70%. European stock markets outperformed their North American counterparts with the UK market (FTSE100) up 6.13%, France’s market (CAC 40) rallied 7.72% and the German market (DAX 30) skyrocketed by 9.16%. Most Asian markets did not make any gains in January, with some markets like India and Japan experiencing slight declines. Last month market sentiment was driven by several concerns. Market values of American AI related stocks fell due to investor concerns that Chinese AI firm DeepSeek was able to produce strong AI query results using a lower cost platform than the more expensive models being implemented by American AI firms. Market participants are still concerned about inflation and its impact on interest rates. Although the U.S. inflation rate has been inching upwards over the last few months, the market has largely ignored it. If the upward trend in inflation does not reverse or begins to pick up pace market participants may begin to get more nervous. In January, President Trump’s announcement of pending tariffs on 25% of Canadian and Mexican imports, as well as 10% tariffs on Chinese exports made market participants nervous about the economic implications. Although the Trump administration placed a one month hold on Canadian and Mexican tariffs, the Chinese tariffs were implemented. Given President Trump’s predilection for tariffs, we can expect that more tariffs will be rolled out over the course of his presidential term and market participants will have to accept the volatility that they bring. Global Stock Markets – January 2025  1 (Source: Bank of Canada) 2(Source: Statistics Canada) 3(Source: United States Bureau of Labour Statistics) 4(Source: United States Federal Reserve) 5(Source: United States Census Bureau) 6(Source: United Nations) 7(Source: World Bank) 8(Source: Koyfin as of January 31, 2025, 5:00 PM)  Desmond Rubie, BCom, FCSI®, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private Wealth Insurance Advisor | iA Private Wealth Insurance* 26 Wellington Street East, 2nd Floor, Toronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 Desmond.Rubie@iaprivatewealth.ca Schedule a Meeting rubiewealth.com * This information has been prepared by Desmond Rubie, BCom, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc. IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. *Insurance products are provided through iA Private Wealth Insurance, which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund. |

Leave a Reply