| MONTHLY MARKET ANALYSIS JULY 2025 |

| Economy The Trump Administration’s still ongoing Tariff Negotiations and Escalating Tariff Threats The United States July 9th deadline date to conclude trade negotiations with all of its trading partners has passed with only four trade deal frameworks announced. The U.S. has announced trade framework deals with the United Kingdom, China, Vietnam, and Indonesia. In the last month the Trump administration has threatened additional tariffs on Canadian, European, Mexican, and Brazilian goods, as well as copper imports. Starting on August 1st, import tariffs on Mexican and European goods will rise to 30%, while Canadian imports will be charged a tariff of 35%. (Canadian and Mexican goods covered under the existing CUSMA trade agreement are exempt). Copper imports (refined copper and semi-finished copper goods) into the United States will be charged 50% starting on August 1st. President Trump is also, not happy with how the current Brazilian government is treating the previous head of Brazil’s government, so Brazil will have to pay 50% tariffs on goods exported to the U.S. starting on August 1st. |

Trump Tariffs Note: Tariffs on American imports are expected to increase the price of goods for American consumers and cut into the profits of American businesses. Nevertheless, the Trump administration has decided to utilize import tariffs to achieve their priorities: 1. Tariffs are being implemented to encourage companies to manufacture their products in the United States. The Trump administration assumes that companies will eventually produce their products in the United States to avoid tariffs. 2. The revenue from tariffs will be used to help pay for the extension of expiring tax reduction legislation, which was originally enacted in 2017 during Donald Trump’s first administration. The Congressional Budget Office estimates the cost of extending the 2017 tax cut legislation for ten additional years would be $4.6 Trillion. 3. Tariffs on U.S goods are being implemented to help eliminate the American trade deficit with other countries. The U.S. tariffs will be used as leverage to coerce other countries to lower their own tariffs and non-tariff barriers. 4. Tariffs are being used as punishment for countries that refuse to carry out American demands. Active Trump Tariffs Implemented in 2025* • 30% tariff on Chinese goods. • 10% tariff on Eurozone goods. • 25% tariff on Canadian Goods (Except goods covered under the Canada-United States-Mexico trade agreement). Canada has responded with retaliatory tariffs • 25% tariff on Mexican Goods (Except goods covered under the Canada-United States-Mexico trade agreement) • 50% tariff on all steel and aluminum imports into the United States. Canada and the European Union have responded with retaliatory tariffs. • 10% minimum tariff on all goods imported into the United States. • 25% tariff on all automobiles not assembled in the United States. * All tariff rates are now being negotiated between individual countries or trading blocks and the Trump administration. Conditions in which Trump Tariffs will be Lowered or Eliminated 1. Legal: Trump’s tariffs mostly contravene international trade law, but enforcing these laws can be a long, tedious process often with no enforceable remedies. American industries that are impacted by Trump’s tariffs often have lobby groups that can challenge the legality of the Trump tariffs in U.S. courts. The United States Congress could also intervene, since tariffs are typically under their purview, but Republicans have a majority in Congress and are unlikely to move against their party leader. 2. Political Backlash: The negative impact of higher consumer prices in the United States and/or the unavailability of needed/desired goods due to retaliatory actions taken by other countries may generate political backlash from U.S. consumers and businesses. 3. Trade Negotiations: At any time, trade negotiations between the United States and its trading partners around the world could lower or eliminate the newly enacted tariffs. 4. U.S. Midterm Elections: In November 2026, U.S. Congressional Elections may change the political environment. If American voters are unhappy with how the Trump tariffs are impacting their lives, Republicans could lose their majority in Congress. 5. Four Year Presidential Term: In less than four years Donald Trump will complete his second and final term as the President of the United States of America. A newly elected American President could undo the Trump tariffs, if they are still in place. |

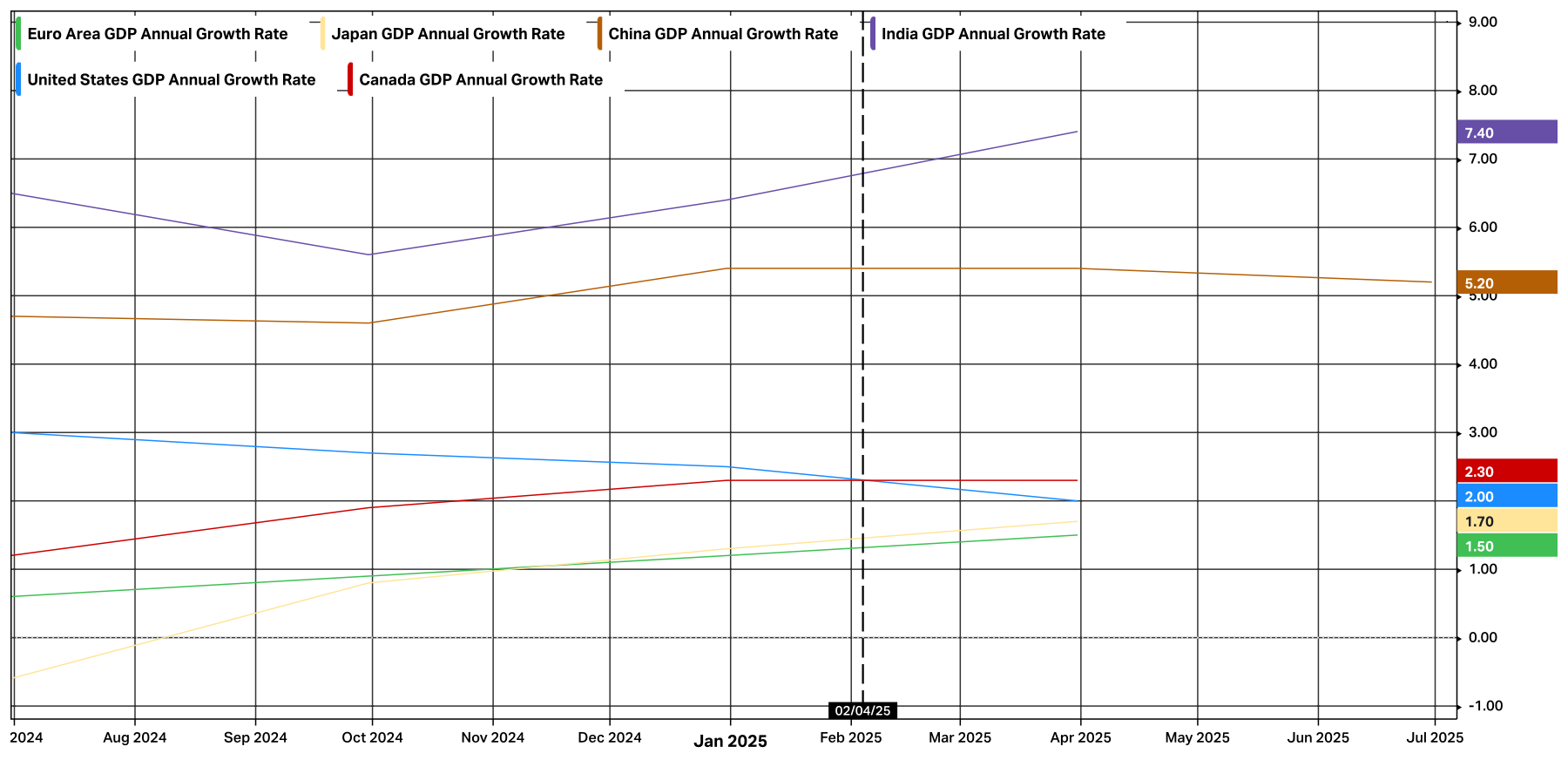

| Global Economic Growth (Annualized GDP Growth Rate) After the Trump Tariffs – 1 Year Chart |

| Country | Economic Decline after the Trump Tariffs |

| United States | -0.5% |

| China | -0.2% |

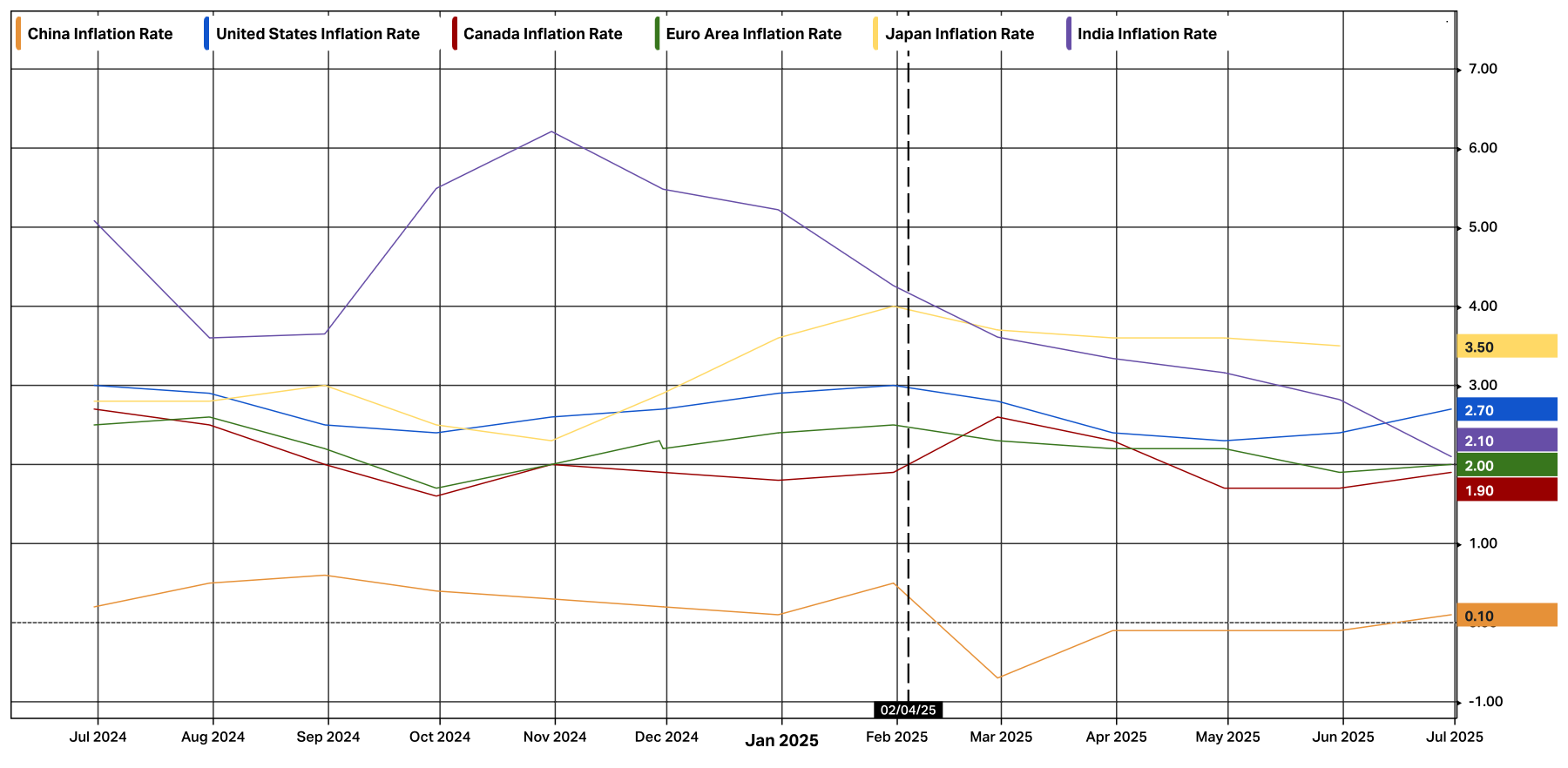

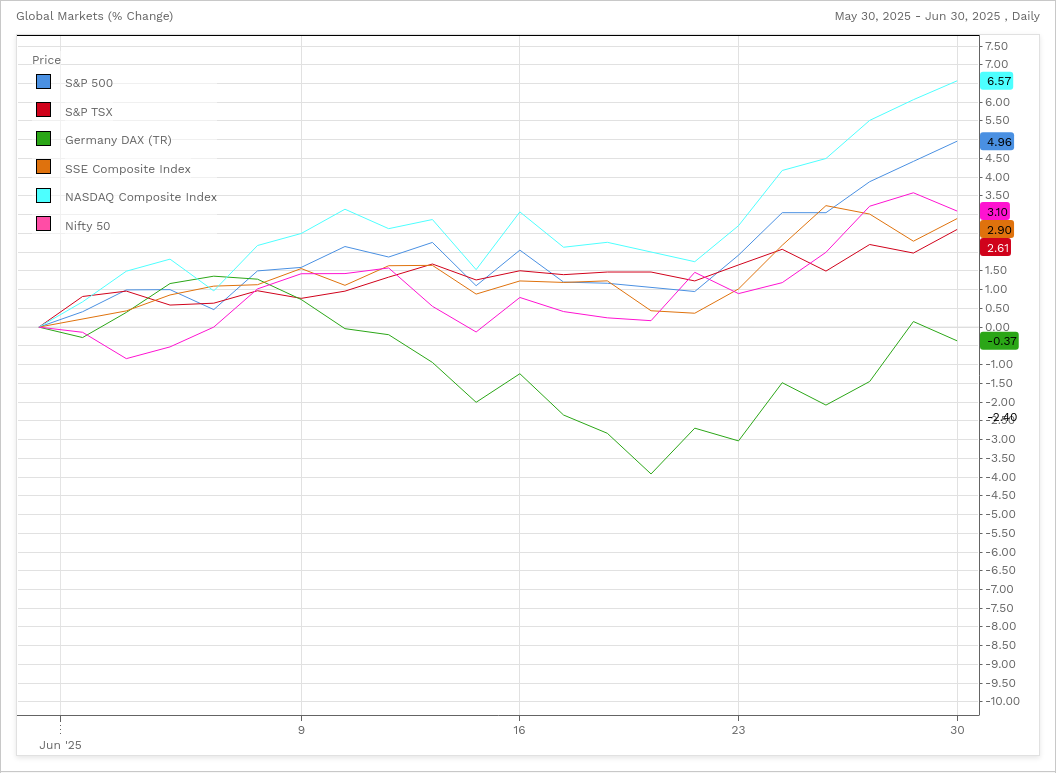

Global Annual GDP Growth Rates after the Trump Tariffs (Trump tariffs started on February 4th): The U.S. economy’s (blue) annual growth rate declined from 2.5% to 2.0%. The Canadian economy’s (red) annual growth rate was unchanged at 2.3%. China’s annual economic growth rate (brown) fell from 5.4% 5.2%. The Eurozone’s annual economic growth rate (green) increased from 1.2% to 1.5%. The Japanese annual economic growth rate (yellow) rose from 1.30% to 1.70%. India’s annual economic growth rate (purple) increased from 6.4% to 7.4%.  Data provided by Koyfin Global Inflation Rates (Annualized) After the Trump Tariffs – 1 Year Chart Global Annual Inflation Rates after the Trump Tariffs (Trump tariffs started on February 4th): Since the Trump tariffs were implemented the inflation rate for all the tracked economies have moved lower, except Canda whose inflation rate remained the same. Canada’s inflation rate (red) was unchanged from 1.9% to 1.9%, United States’ inflation rate (blue) declined from 3.0% to 2.7%, the Eurozone inflation rate (green) fell from 2.5% to 2.0%, China’s inflation rate (brown) declined from 0.5% to -0.10%, Japan’s inflation rate (yellow) fell from 4.0% to 3.5%, and India’s inflation rate (purple) fell from 4.26% to 2.10%.  Data provided by Koyfin United States The U.S. economy continues to add jobs at a moderate pace. In June, 147,000 additional jobs were generated, while the unemployment rate fell from 4.2% to 4.1%. Tariffs have not had a major impact on the United States labour market yet, but job creation in manufacturing, mining and energy have seen some declines. The U.S. inflation rate moved up for the third consecutive month in June, increasing to 2.7% from 2.4% in May. According to the U.S. Bureau of Labour Statistics, the higher inflation rate was led by food prices (up 3.0%), transportation services (up 3.4%) as well as used cars and trucks (up 2.8%). The U.S. Federal Reserve is very concerned with rising inflation rates and will likely keep the benchmark Federal Funds rate at 4.5% in their upcoming meeting on July 30th. U.S. retail sales increased by 0.6% in June a dramatic rebound from the -0.9% decline in May. The volatility in retail sales over the last two months, will necessitate a close review of July’s retail sales data. July’s retail sales data will provide additional data on how American consumers may be changing their spending habits in response to higher tariff rates on imported goods. Canada In June, Canada added a phenomenal 83,100 jobs, while the unemployment rate fell from 7.0% to 6.9%. The improvement in Canadian job creation is a welcome change, after four months of weak job growth and a rising unemployment rate. The positive job numbers were unexpected, so we will have to wait until next month’s report to determine if we are seeing a true turnaround in the Canadian labour market. The Canadian inflation rate moved up slightly in June, from 1.7% to 1.9%. Although, inflation is still below the 2.0% Bank of Canada target rate, they are likely to hold the Canadian overnight interest rate at 2.75% in their next meeting on July 30th. The Bank of Canada will need to consider U.S. tariff uncertainty and the recent rebound in the labour market activity in their decision making. On a less positive note, Canadian consumers have cut back on their spending, shown in the decline of retail sales by -1.1% during the month of May, following two consecutive positive months. Also, Canadian home prices continue to decline, falling -0.5 in June, the eighth consecutive monthly decline. Markets Global stock markets The Canadian and U.S. stock markets had another strong month in June as investors took a more relaxed view of U.S. tariff risks. During the month of June, the U.S. Market (S&P 500) was up 4.96% while the Canadian market (S&P/TSX Composite Index) was up 2.61%. The U.S. Nasdaq Composite index which contains a high weighting of technology related stocks was up 6.57%. The German stock market (Dax 40 index) decreased by -0.37%, while the Chinese market (Shanghai Composite Index) increased by 2.90% and the Indian market (Nifty 50 Index) was up 3.1%. Change in Global Stock Markets the Month of June 2025  Data provided by FactSet The July 9th tariff negotiation deadline date has passed, and has now been replaced by a new deadline of August 1st. Global stock markets have taken most of the Trump administration’s recent tariff threats with a grain of salt and will likely continue to do so until significant negative economic developments arise. We will get the United States second quarter economic growth rate (GDP) on July 30th, which will give market participants additional insight on the impact of the recently enacted trump tariffs. Higher inflation will continue to be a major concern to investors as it will influence the U.S. Federal Reserve’s willingness to cut rates and may curtail the purchasing power of American consumers. Corporate earnings being announced this month will also influence market sentiment. |

| * This information has been prepared by Desmond Rubie, BCom, FCSI®, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, FCSI®, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc. *IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.  Desmond Rubie, BCom, FCSI®, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private Wealth Insurance Advisor | iA Private Wealth Insurance* 26 Wellington Street East, 2nd Floor, Toronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 Desmond.Rubie@iaprivatewealth.ca Schedule a Meeting rubiewealth.com Fellow of CSI (FCSI®) iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. *Insurance products are provided through iA Private Wealth Insurance, which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund. |

Leave a Reply