| Monthly Market Analysis March 2025 |

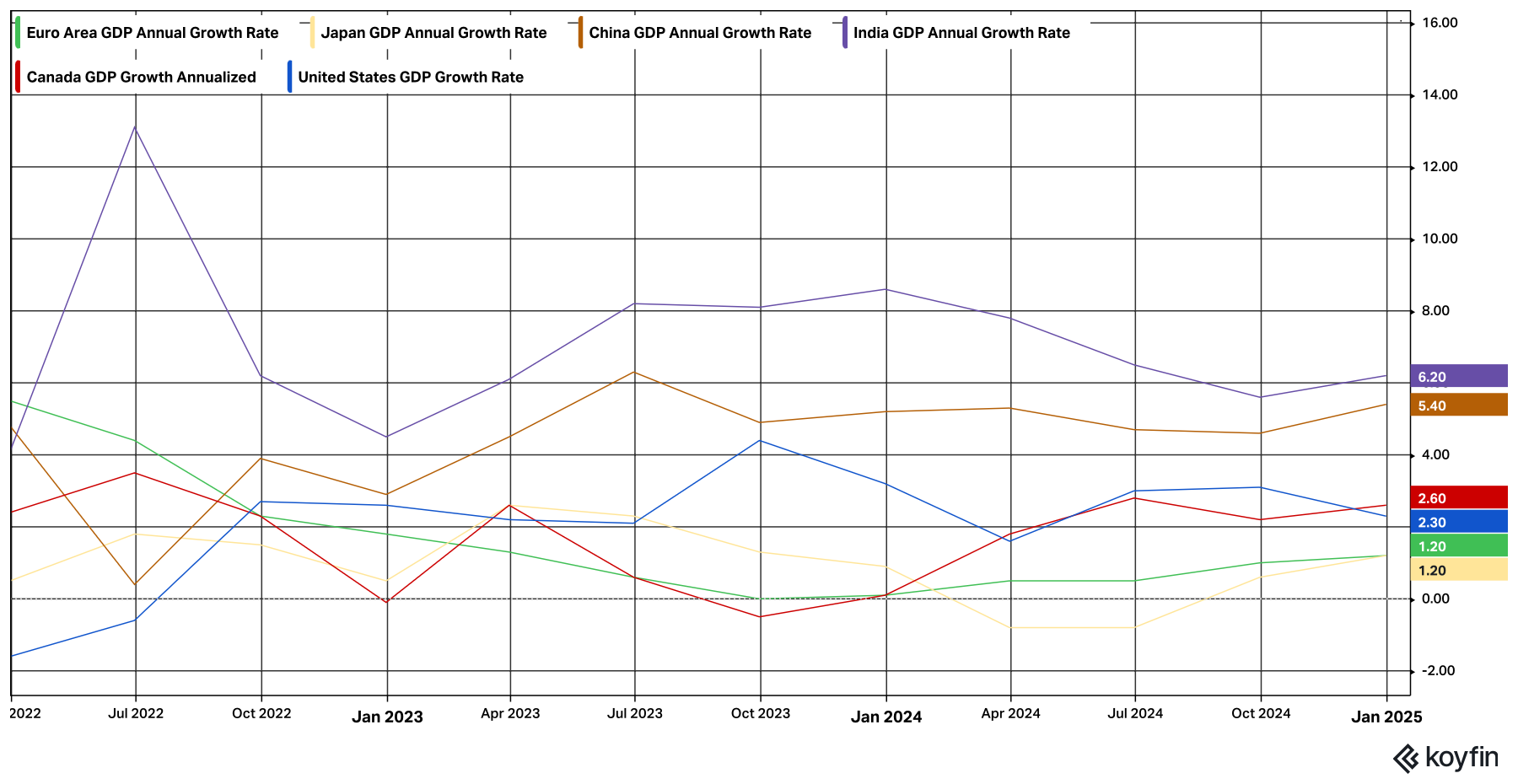

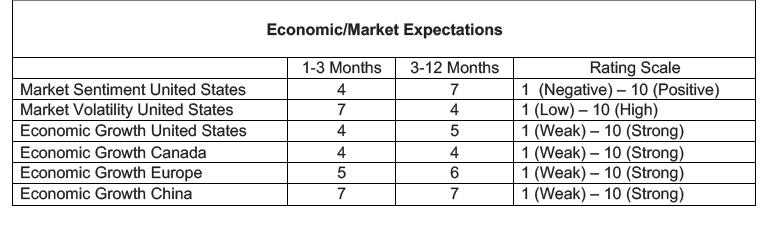

| Economy Tariffs The United States has implemented direct tariffs on China, Canada, and Mexico. In the coming months, we will need to examine the economic impact the tariffs, and retaliatory tariffs have on all countries involved. The Trump administration has also added tariffs on steel and aluminum imports and plans to impose “reciprocal” tariffs on specific goods from countries that have a trade deficit with the United States. • 20% tariff on Chinese goods. China has responded with retaliatory tariffs • 25% tariff on Canadian Goods (temporary reprieve on United States-Mexico-Canada Free Trade agreement covered goods until April 2nd). Canada has responded with retaliatory tariffs • 25% tariff on Mexican Goods (temporary reprieve on US, Mexico, Canada Free Trade agreement covered goods until April 2nd) • 25% tariff on all steel and aluminum imports into the United States. Canada and the European Union have responded with retaliatory tariffs • United States “Reciprocal” Tariffs to be implemented on April 2nd Global Economic Growth Rates Prior to implementation of United States Trade War In the fourth quarter of 2024 the Canadian economy picked up pace, with the GDP growth rate increasing to 2.60%. The United States GDP growth rate slowed to 2.3% in the same period. The Eurozone economy grew at an improved 1.2% GDP growth rate. The Chinese economy sped up with a 5.4% GDP growth rate. Japan’s economic growth has also improved with a GDP growth rate of 1.20%. After a drop in economic growth in India over the last year, its GDP growth rate is beginning to increase again at 6.2%  United States The U.S. generated 151,000 jobs in February while the unemployment rate increased from 4.0% to 4.1%. In a sign that consumers have begun cutting back on spending, U.S. monthly retail sales declined by -0.9% in the latest month of data. On March 17th we will get fresh U.S. monthly retail sales data and further evidence to determine the health of the U.S. consumer. Last month the U.S. inflation rate fell from 3.0% to 2.8%. In the coming months we will continue to monitor the impact of tariffs on inflation. The U.S. Federal Reserve is expected to maintain rates at 4.5% during their interest rate meeting on March 19th. Canada Canada generated a minimal 1,100 jobs, in February, while the unemployment rate remained unchanged at 6.6%. Retail sales in Canada declined in January to -0.4%, after showing very strong growth of 2.5% in December. Canada’s retail spending for the month of February will be released on March 21st. In anticipation of downward economic pressure due to United States tariffs, the Bank of Canada reduced overnight interest rates by 0.25% on March 12th. Overnight interest rates are now 2.75% in Canada. Markets North American stock markets declined during the month of February due to concerns over the expected negative economic impact of American tariffs. Last month, the U.S. Market (S&P 500) was down -1.87% while the Canadian market (S&P/TSX Composite Index) was down marginally -0.1%. The U.S. Nasdaq Composite index which contains a high weighting of technology related stocks was down -4.49%. The German stock market was up 5.23%. North American market volatility is expected to continue over the coming weeks as the United States continues to impose import tariffs on additional countries. April 2nd is the date announced by the Trump administration for the introduction of the next round of tariffs.  |

| 1 (Source: Bank of Canada) 2(Source: Statistics Canada) 3(Source: United States Bureau of Labour Statistics) 4(Source: United States Federal Reserve) 5(Source: United States Census Bureau) 6(Source: FactSet as of February 28, 5:00 PM) * This information has been prepared by Desmond Rubie, BCom, FCSI®, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, FCSI®, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc. *IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.  Desmond Rubie, BCom, FCSI®, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private Wealth Insurance Advisor | iA Private Wealth Insurance* 26 Wellington Street East, 2nd Floor,Toronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 Desmond.Rubie@iaprivatewealth.ca Schedule a Meetingrubiewealth.com Fellow of CSI (FCSI®) iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. *Insurance products are provided through iA Private Wealth Insurance, which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund. |

Leave a Reply