| Monthly Market Analysis October 2025 |

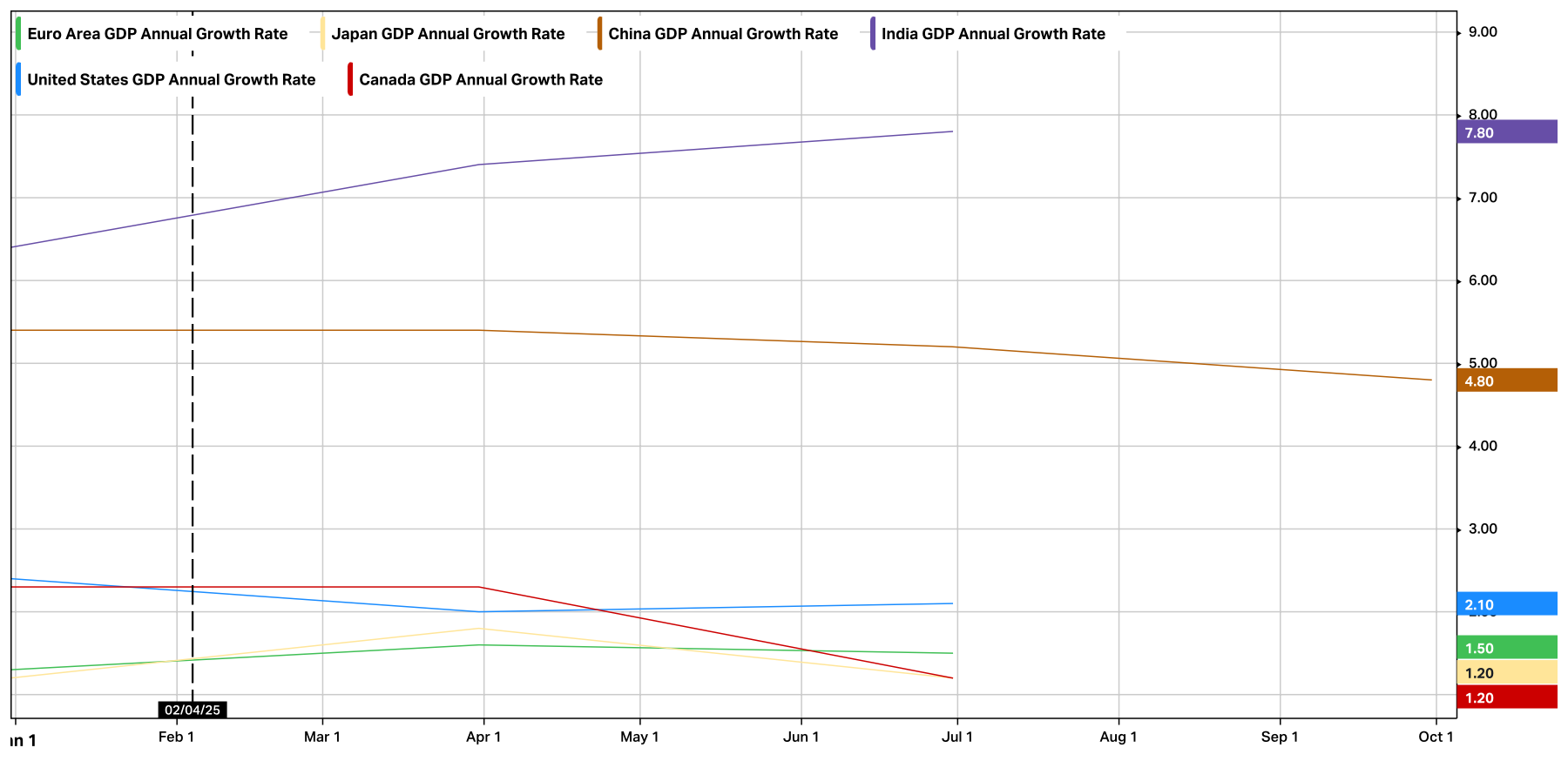

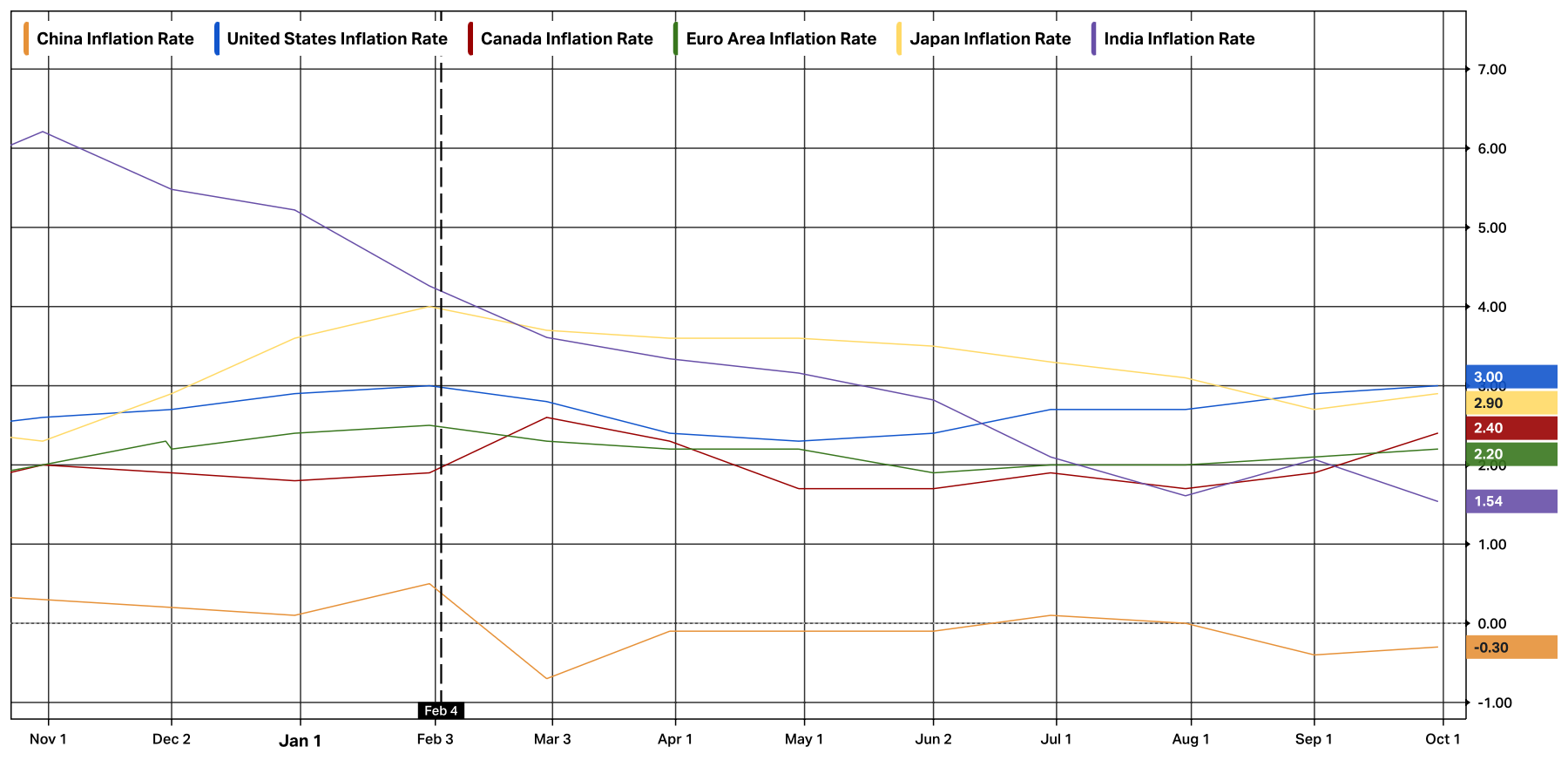

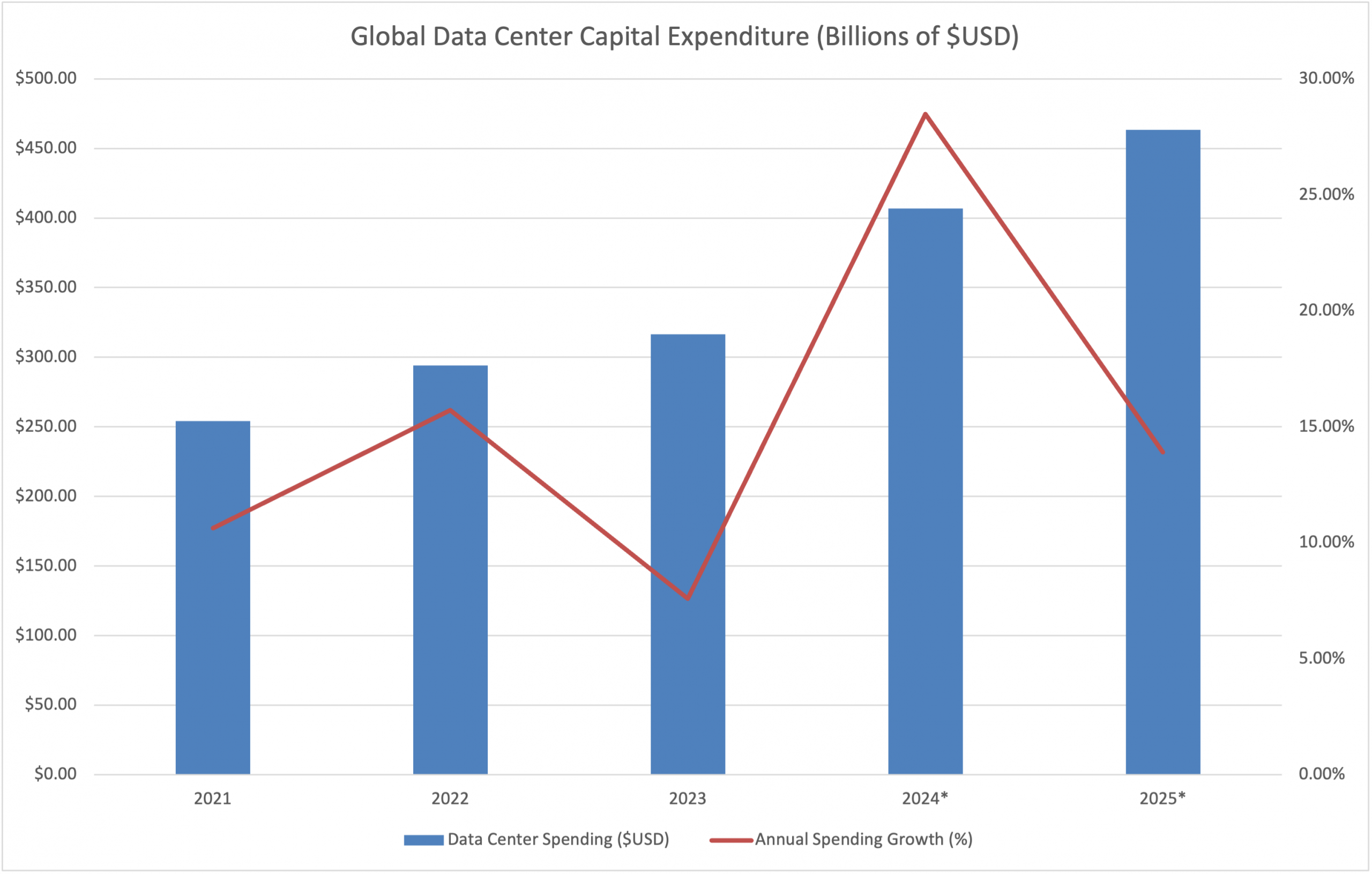

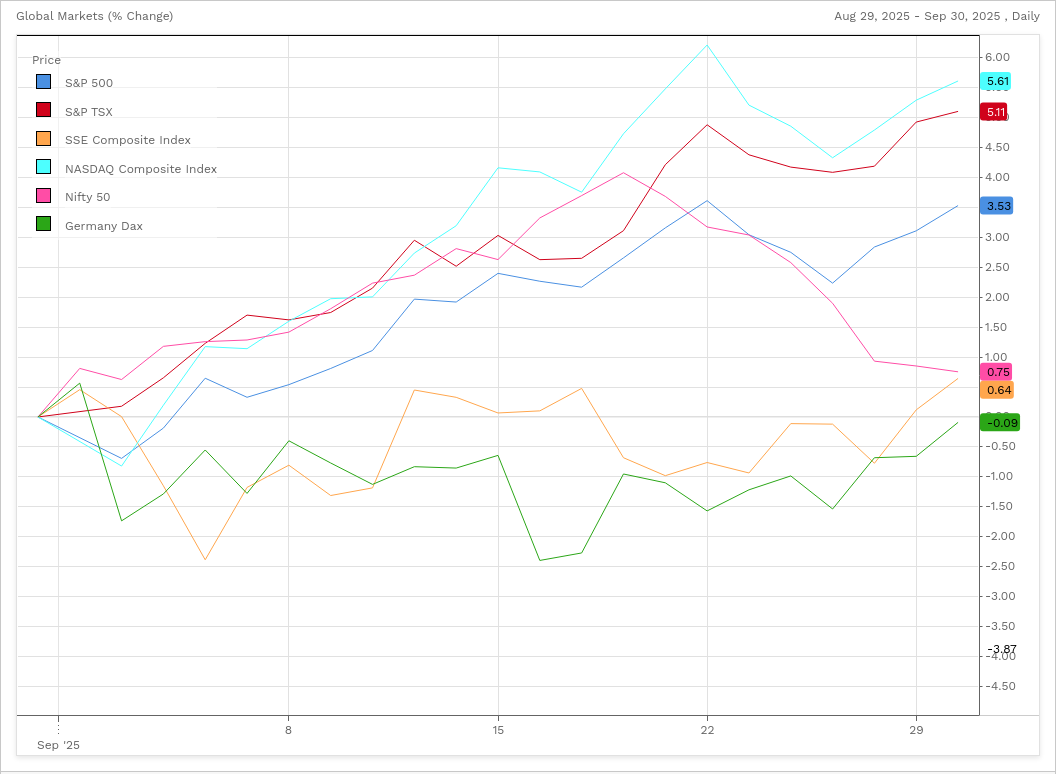

| Economy Global Annual GDP Growth Rates after Trump’s Tariffs Declining Economies (among the six economies in our tracking) Change in Economic Growth after Trump’s Tariffs United States -0.4% Canada-1.1% China-0.6% Japan-0.1% Global Economic Growth (Annual GDP Growth Rate) – 1 Year Chart (*Dotted line shows shows start of Trump’s Tariffs, February 4th)The U.S. economy’s (blue) annual growth rate declined from 2.5% to 2.1%. The Canadian economy’s (red) annual growth rate declined from 2.3% to 1.2%. China’s annual economic growth rate (brown) fell from 5.4% to 4.8%. The Eurozone’s annual economic growth rate (green) increased from 1.2% to 1.5%. The Japanese annual economic growth rate (yellow) declined from 1.30% to 1.20%. India’s annual economic growth rate (purple) increased from 6.4% to 7.8%.  Global Annual Inflation Rates after Trump’s Tariffs Rising Inflation (among the six economies in our tracking) Economies with Rising Inflation after Trump’s Tariffs Canada+0.5% Global Inflation Rates (Annualized) – 1 Year Chart (*Dotted line shows shows start of Trump’s Tariffs, February 4th) Since Trump’s Tariffs were implemented the inflation rate for all the tracked economies have moved lower except Canada and the United States. Canada’s inflation rate (red) has increased from 1.9% to 2.4%. The United States’ inflation rate (blue) is unchanged at 3.0%. The Eurozone inflation rate (green) fell from 2.5% to 2.2%. China’s inflation rate (brown) declined from 0.5% to -0.3%. Japan’s inflation rate (yellow) fell from 4.0% to 2.9%, and India’s inflation rate (purple) fell from 4.26% to 1.54%.  United States Please note: (United States’ economic data is currently stale due to the shutdown of the U.S. Government on October 1st, which has impacted the ability for many of their statistical agencies to collect and report research data) Due to the U.S. Government shutdown the last update on job creation and unemployment in the U.S. was in August, where 22,000 additional jobs were generated and the unemployment rate was 4.3%. The latest available data on consumer spending is also August, in which retail sales increased by 0.6%. The United States inflation rate is required for many U.S. government programs, so September’s inflation data was reported despite the Government shutdown, albeit later than usual on October 24th. During the month of September inflation moved higher for the third consecutive month moving up from 2.9% to 3.0% – inflation was only 2.3% in April. The U.S. Federal Reserve’s voting members must decide next week Wednesday, October 29th, if they should cut interest rates for a second consecutive meeting. They will have to consider rising inflation which may be exacerbated by lower interest rates. The Federal Reserve members must also hypothesize about the labour market without any up-to-date labour data, due to the government shutdown. We will get an update on the pace of economic growth in the United States, when quarterly GDP growth estimates for the third quarter of 2025 is reported on Thursday, October 30th . Economists expect a slower pace of growth than the 3.8% GDP growth rate generated in the second quarter of 2025. Canada The Canadian economy saw a remarkable 60,400 additional jobs generated in the month of September. The job growth in September was a dramatic turnaround from the month of August when the Canadian economy lost -65,500 jobs. In September, the unemployment rate was unchanged at 7.1%. Canadian consumers pulled back on spending in September as preliminary retail sales fell by -0.7% after rising by 1.0% in August. In September, the Canadian inflation rate moved upwards for a second consecutive month, from 1.9% to 2.4%. The inflation rate has once again surpassed the Bank of Canada’s 2% target. The higher inflation reading and strong job creation in September may spur the Bank of Canada Governing Council to leave interest rates unchanged in their upcoming meeting on October 29th. Tariffs On October 14th, the United States increased tariff rates on timber and lumber by 10% and added tariffs of 25% on upholstered furniture, vanities and cabinets. Three days later, on October 17th the Trump administration announced a new 25% tariff on heavy-duty trucks, and a 10% tariff on all busses imported into the United States, beginning on November 1st. Artificial Intelligence Data Centre Spending Growth Generative AI software tools such as OpenAI’s ChatGPT, Google’s Gemini, and X’s Grok etc., are consistently gaining millions of additional daily users. The increasing use of generative AI tools has widened the need to build data centres which are the computerized “brains” that power these AI models. A very conservative estimate by Omdia (a technology research firm) projects $463.36 Billion USD will be spent on building data centres globally in 2025.  Source: Omdia. 2021-2023 actual expenditures. * 2024-2025 projected expenditures. Markets Global Stock Markets Investor FOMO (fear of missing out) continues to push market returns higher. Frequent announcements of new AI infrastructure spending has some investors excited about the technology boom underway, while other investors are concerned about an AI bubble. During the month of September the market was driven by the investors who are enthusiastic about AI’s future. Technology companies lead the way, but gold, financial and energy producers also drove market returns. Rate cuts by the U.S. Federal Reserve and the Bank of Canada also contributed to investor enthusiasm. During the month of September, the U.S. Market (S&P 500) was up 3.63%, while the Canadian market (S&P/TSX Composite Index) had another strong month and grew by 5.11%. The U.S. Nasdaq Composite index which contains a high weighting of technology related stocks increased by 5.61%. The German stock market (Dax 40 index) fell for a second consecutive month, it was down by -0.09%. The Chinese market (Shanghai Composite Index) was up a mere 0.64% and the Indian market (Nifty 50 Index) was up slightly by 0.75%. Change in Global Stock Markets the Month of September 2025  FactSet® So far in October the market has seen some volatility, as trade related conflicts have begun to flare up again between the United States and China. Some market participants are beginning to decrease their holdings in technology related companies, due to concerns about AI overspending. The upcoming interest rate decision by the U.S. Federal Reserve and the Bank of Canada on October 29th, will have a big impact on the final performance of global markets in October. |

| 1 (Source: Bank of Canada) 2(Source: Statistics Canada) 3(Source: United States Bureau of Labour Statistics) 4(Source: United States Federal Reserve) 5(Source: United States Census Bureau) 6(Source: FactSet as of September 30,2025, 5:00 PM) * This information has been prepared by Desmond Rubie, BCom, FCSI®, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, FCSI®, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc. *IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.  Desmond Rubie, BCom, FCSI®, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private Wealth Insurance Advisor | iA Private Wealth Insurance* 26 Wellington Street East, 2nd Floor, Toronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 Desmond.Rubie@iaprivatewealth.ca Schedule a Meeting rubiewealth.com Fellow of CSI (FCSI®) iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. *Insurance products are provided through iA Private Wealth Insurance, which is a trade name of PPI Management Inc. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investor Protection Fund. |

Leave a Reply