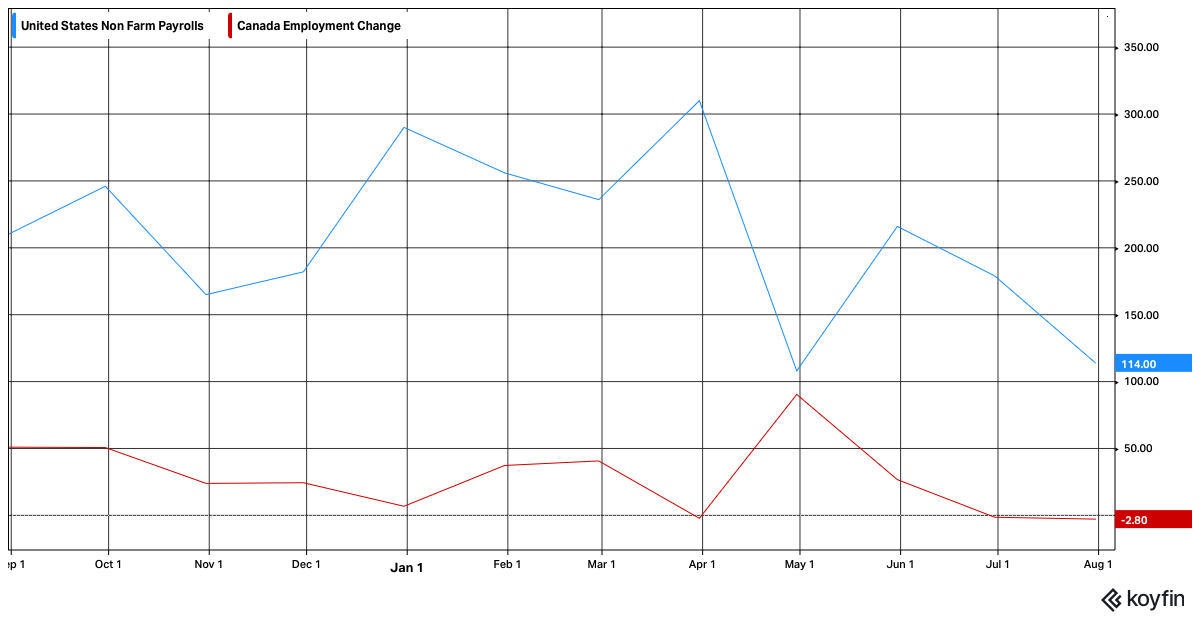

Monthly Market Analysis September 2024 Economy United States The question on many economists’ minds is: whether the U.S. economy is headed for a crash or just a slowdown? By many measures, the U.S economy is still showing signs of continued growth. Second quarter economic growth as measured by GDP was revised upward last month to 3.0%. In its latest reading last month, retail sales rebounded by 1.0%, after showing no growth (0%) the previous month. Also, inflation’s drag on the U.S. economy lessened last month as consumer inflation fell from 3.0% to 2.9%. The area of the U.S. economy that has many economists concerned is the labour market. Last month, the U.S. economy generated a relatively low 114,000 jobs, while the unemployment rate increased from 4.1% to 4.3. The last time in recent years we saw job growth this weak was this April at 104,000 jobs. The unemployment rate has been on a steady climb since January when it was 3.7%. At 4.3%. The unemployment rate is still historically low, but it is well above the 3.5% achieved in February 2020, before the pandemic started. Over the next coming months as inflation becomes less of a concern, the labour market will be the focus of the United States Federal Reserve. It is likely that the U.S. Federal Reserve will begin cutting interest rates in their meeting on September 18th. Canada The Canadian economy has shown positive, growth momentum in the second quarter of 2024 as measured by its GDP. Canadian GDP grew a respectable 2.1% in the second quarter. Although Canadian GDP has improved, the labour market is still showing signs of weakness. The Canadian economy lost -2,800 jobs last month. Consumers spending also further weakened as retail sales fell by -0.3% during the latest reading, which was the second consecutive month of decline. Retail sales have declined for five of the last six months. Hopefully, last month’s drop in Canada’s inflation rate from 2.7% to 2.5% will alleviate some of the pricing pressures many Canadian household budgets are experiencing. The decline in inflation will likely give the Bank of Canada more reason to cut interest again in their meeting on September 4th. United States/Canadian Employment Change (last 12 months)  United States/Canadian Unemployment (last five years)  Markets Investors continued to experience volatile market conditions last month. The U.S. S&P 500 index started last month -3.59% below its all-time high, then fell further to -8.49% below its all-time high, but eventually ended the month only -0.33% below its all-time high. Overall, the S&P 500 was up 3.9% last month. The Nasdaq 100 index which is heavily weighted with many of the largest technology companies in the world, fell by as much as -6.25% but eventually rebounded, ending up 2.59% last month. The Canadian companies represented in the TSX index collectively ended last month up 2.28% after dropping by -5.53% during the first week of the month. As mentioned earlier, the strength of the U.S. job market is a major concern for bond and stock market investors. Inflation appears to be in decline, but we must continue to monitor its path. Last month’s political events in the United States did not have any major impact on markets, but we still have a little over two months to go. 1 (Source: Bank of Canada) 2(Source: Statistics Canada) 3(Source: United States Bureau of Labour Statistics) 4(Source: United States Federal Reserve) 5(Source: United States Census Bureau) 6(Source: Koyfin as of August 31,2024, 5:00 PM) | |||||

* This information has been prepared by Desmond Rubie, BCom, CIM®, CFP®, who is a Wealth Advisor for Rubie Wealth Management Group at iA Private Wealth. Opinions expressed in this article are those of Desmond Rubie, BCom, CIM®, CFP® only and do not necessarily reflect those of iA Private Wealth Inc. IA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.  Desmond Rubie, BCom, CIM®, CFP® Wealth Advisor Rubie Wealth Management Group | iA Private Wealth 26 Wellington Street East, 2nd FloorToronto, ON M5E 1S2 T: 647-429-3281 ext. 240018 | M: 416-795-6100 Desmond.Rubie@iaprivatewealth.ca Schedule a Meeting iaprivatewealth.ca |

Leave a Reply